Back

Small Business, Big Capital: Analyzing the INVEST Act's Impact on Venture Funding and Regulation.

Gana Misra

Dec 15, 2025

Updates

The Investing in New Venture Entrepreneurship and Small Businesses (INVEST) Act represents a significant legislative intervention in the American capital formation landscape. As venture capital continues to play an increasingly critical role in economic growth and innovation, understanding the Act's provisions, implementation challenges, and market impacts has become essential for stakeholders across the entrepreneurial ecosystem.

Legislative Context and Framework

The INVEST Act emerged from bipartisan recognition that existing securities regulations, while designed to protect investors, had created unintended barriers to capital formation for emerging companies. The legislation builds upon previous reforms, including the Jumpstart Our Business Startups (JOBS) Act of 2012, while addressing gaps that became apparent through a decade of implementation experience.

The Act's legislative framework rests on several core assumptions: that excessive regulatory burden disproportionately affects smaller market participants, that geographic concentration of venture capital creates inefficiencies, that accredited investor standards had not evolved with financial markets, and that regulatory clarity would facilitate more efficient capital allocation.

Core Regulatory Provisions

1. Expanded Accredited Investor Definition

The Act fundamentally restructures accredited investor qualifications by incorporating professional credentials and demonstrable investment sophistication alongside traditional wealth thresholds. This modification recognizes that financial expertise does not correlate perfectly with net worth or income levels, potentially expanding the qualified investor pool by an estimated 8-12 million individuals.

2. Enhanced Safe Harbor Provisions

New regulatory safe harbors provide clear guidelines for early-stage capital formation activities, reducing legal uncertainty and associated compliance costs. These provisions establish specific conditions under which companies can conduct fundraising activities without triggering general solicitation restrictions or integration concerns.

3. Streamlined Testing-the-Waters Procedures

The Act expands pre-filing communication allowances, permitting companies to gauge investor interest and refine offering terms before committing significant resources to formal registration or exemption processes. This mechanism reduces transaction costs and improves capital formation efficiency.

4. Modified Registration Requirements

Certain registration thresholds and reporting obligations have been adjusted to account for company size, offering amount, and investor composition. These modifications aim to preserve investor protections while reducing compliance burdens that disproportionately affect smaller issuers.

Market Impact Analysis

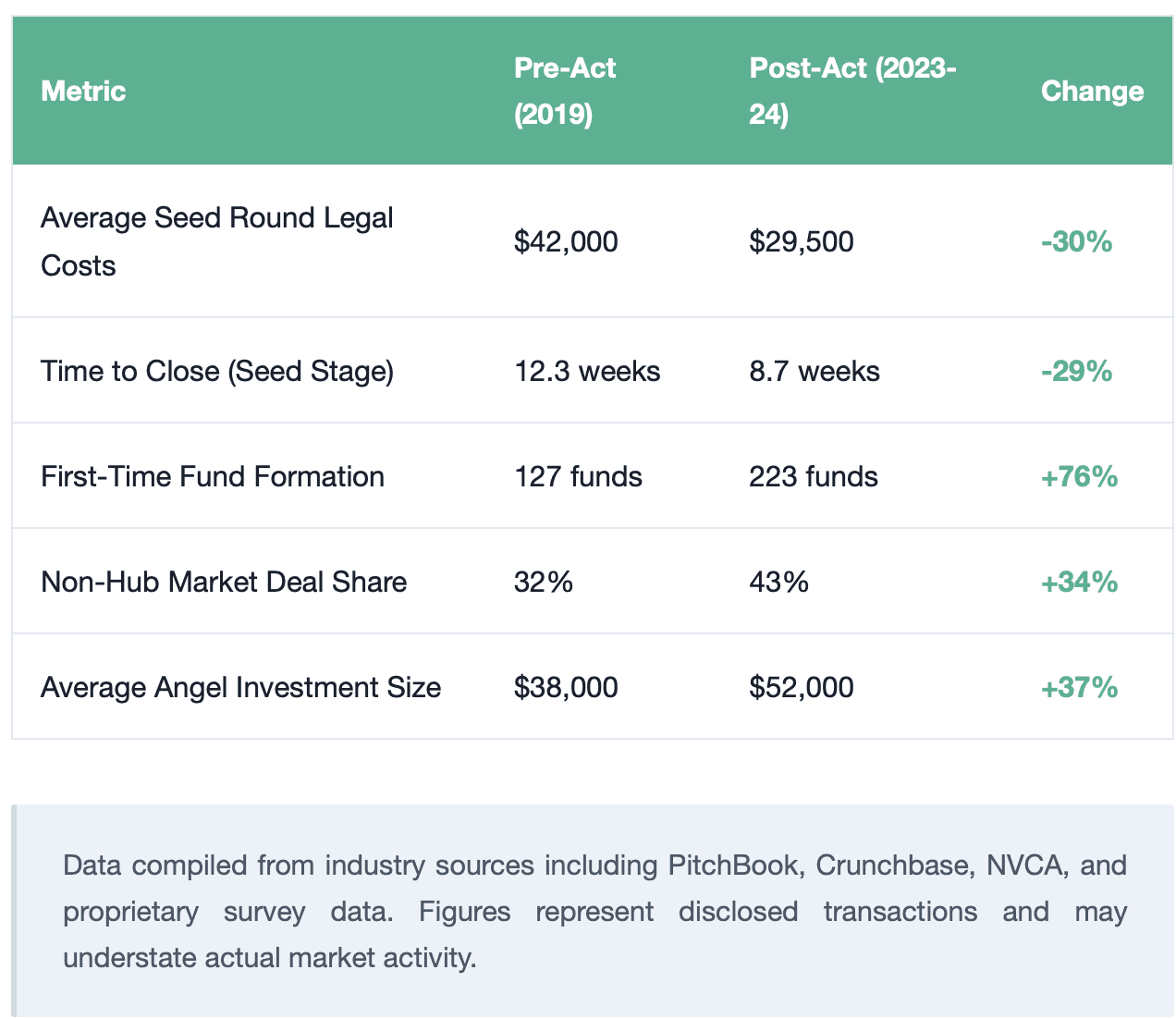

Preliminary data from implementation periods provides insight into the Act's real-world effects on venture capital markets, deal flow patterns, and capital allocation efficiency.

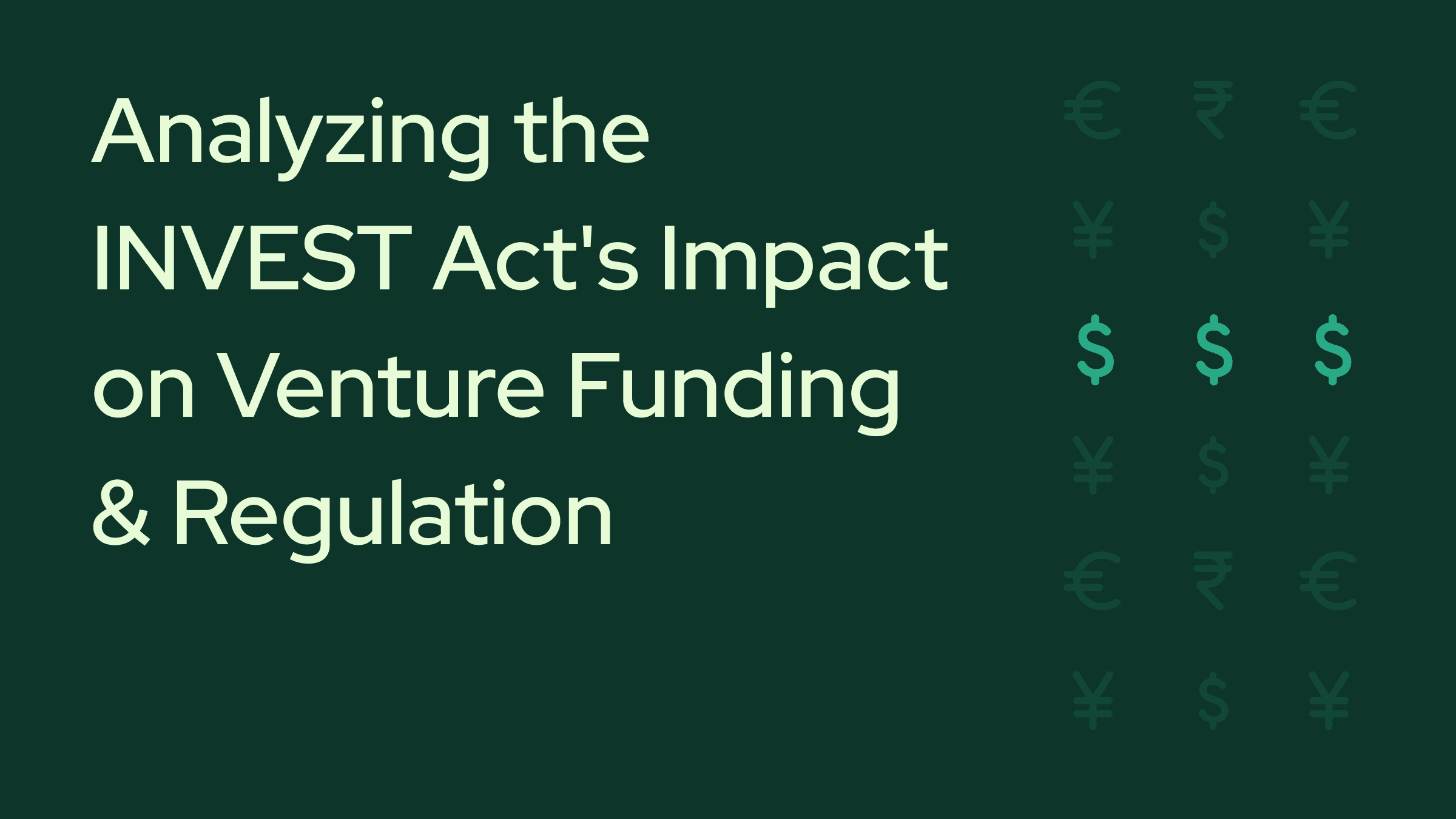

Quantitative Outcomes

Geographic Diversification

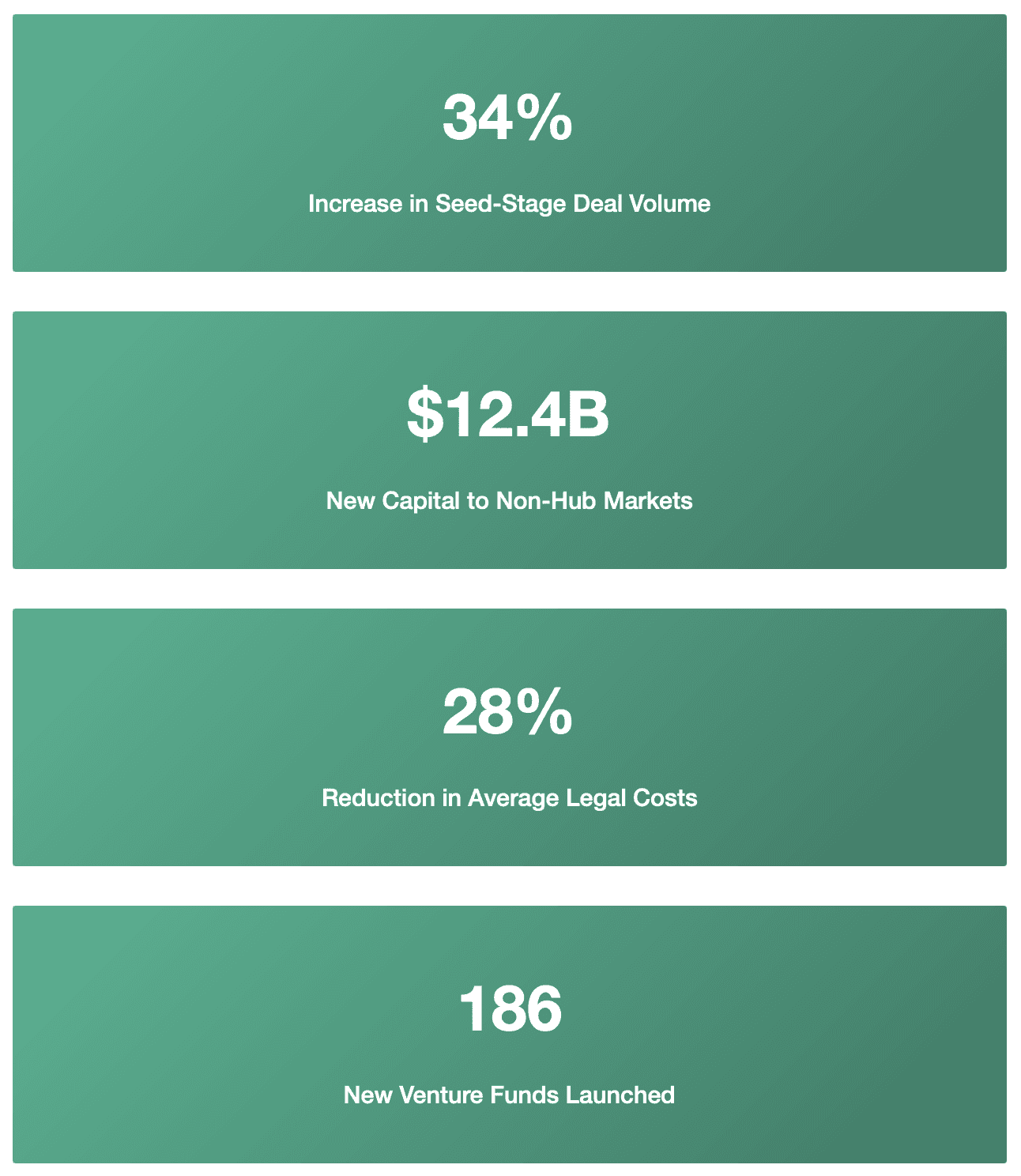

One of the Act's most notable impacts has been accelerated geographic diversification of venture capital deployment. Secondary and tertiary markets have experienced disproportionate growth in both deal volume and capital committed, suggesting reduced friction in capital flows to non-traditional markets.

Implementation Challenges and Concerns

Despite positive early indicators, the Act's implementation has revealed several challenges requiring ongoing attention from regulators, market participants, and policymakers.

Critical Considerations

1 Investor Protection Frameworks

Expanded investor qualifications raise questions about appropriate protection mechanisms for newly eligible participants. While professional credentials indicate sophistication, they may not fully substitute for wealth-based resilience to investment losses.

2 Information Asymmetry

Reduced disclosure requirements in certain contexts may exacerbate information asymmetries between issuers and investors, particularly for less sophisticated participants who now qualify under expanded definitions.

3 Market Quality Concerns

Lower barriers to capital formation may enable funding of marginal ventures that would have been filtered through more stringent processes. Long-term performance data will be necessary to assess whether deal quality has been affected.

4 Regulatory Arbitrage

Multiple exemption frameworks and safe harbor provisions create opportunities for regulatory arbitrage, requiring careful monitoring to ensure rules are applied as intended.

Comparative Analysis: Pre- and Post-Act Metrics

Long-Term Structural Implications

The Act's ultimate impact will emerge over multiple investment cycles as capital flows adjust to new regulatory equilibria and ecosystem development in secondary markets matures.

Ecosystem Evolution

Sustained capital access may enable secondary markets to develop self-reinforcing entrepreneurial ecosystems. Successful exits create experienced operators, angel investors, and recycled capital that fuel subsequent venture generations. This virtuous cycle, previously concentrated in established hubs, may now emerge more broadly across geographic markets.

Innovation Pattern Shifts

Democratized capital access could influence which types of ventures receive funding. Capital-intensive sectors including advanced manufacturing, cleantech, and infrastructure technology may benefit from expanded investor bases and reduced geographic constraints. Software-centric models, while remaining dominant, may face increased competition for capital as deeper investment theses gain traction.

Competitive Dynamics

As venture capital becomes more geographically distributed and competitive, traditional advantages of established firms may erode. Network effects and information asymmetries that historically favored incumbent players may diminish as information flows improve and local expertise develops in emerging markets.

Strategic Considerations for Market Participants

For Entrepreneurs and Founders

Regulatory Awareness: Understanding available exemptions and safe harbor provisions can significantly reduce capital formation costs and timelines. Engaging qualified legal counsel remains essential despite streamlined processes.

Geographic Flexibility: Reduced location dependence enables founders to build companies in markets offering operational advantages, talent availability, or quality of life benefits without sacrificing capital access.

Investor Relationship Management: Expanded investor definitions broaden potential funding sources but require careful consideration of value-add capabilities beyond capital provision.

Due Diligence Standards: Entrepreneurs should maintain robust disclosure practices and governance standards regardless of minimum regulatory requirements, as these factors influence long-term investor relationships and subsequent funding rounds.

For Investors

Deal Flow Diversification: Geographic expansion of venture opportunities requires development of sourcing networks and evaluation capabilities beyond traditional hubs.

Risk Assessment: Reduced information requirements in certain contexts necessitate enhanced due diligence processes and risk management frameworks.

Portfolio Construction: Broader market participation enables more diversified portfolio construction across geographies, sectors, and stage preferences.

Competitive Positioning: First-mover advantages in emerging markets may accrue to investors who develop local expertise and networks early in ecosystem development cycles.

Policy Recommendations and Future Refinements

Based on implementation experience to date, several areas warrant consideration for future regulatory refinement.

Enhanced Investor Education

Expanded participation eligibility should be accompanied by accessible education resources ensuring newly qualified investors understand risks, portfolio construction principles, and liquidity considerations inherent in venture investments.

Performance Monitoring

Systematic data collection on outcomes across different investor categories, geographic markets, and funding mechanisms would enable evidence-based policy refinement and identify areas requiring adjustment.

Harmonization Efforts

Multiple overlapping exemption frameworks create complexity and potential gaps. Ongoing harmonization efforts could improve clarity while maintaining flexibility for diverse capital formation scenarios.

Fraud Prevention

Streamlined processes must be balanced with robust enforcement mechanisms to prevent bad actors from exploiting reduced oversight. Targeted enforcement resources may be necessary to maintain market integrity.