Back

Form 144: The Untold Story of Restricted Stock Sales

Gana Misra

Dec 17, 2025

SEC

Disclosures

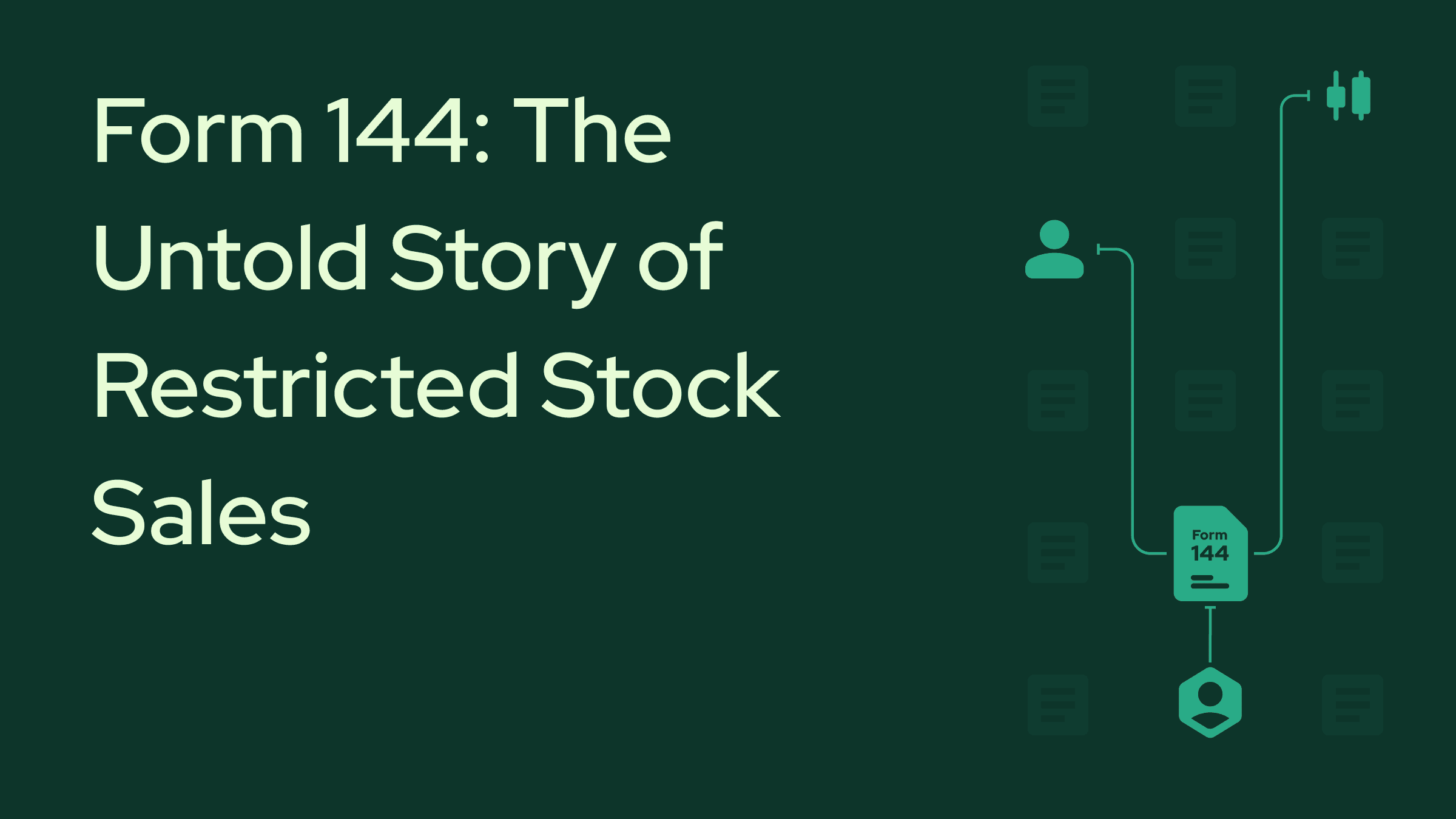

Every day, corporate executives and major shareholders navigate a critical legal requirement before selling their company stock—a document that serves as both a regulatory safeguard and a window into insider activity. Form 144 stands at the intersection of securities law and market transparency, quietly shaping how billions of dollars in restricted stock move through financial markets. Despite its significant role in corporate finance, this essential filing remains one of the least understood aspects of securities regulation.

What Exactly Is Form 144?

Form 144, officially titled "Notice of Proposed Sale of Securities," is the financial equivalent of raising your hand before speaking in class. It's a notification to the Securities and Exchange Commission (SEC) that someone intends to sell restricted or control securities—stocks that can't simply be dumped on the open market without proper disclosure.

But here's where it gets interesting: This isn't just bureaucratic paperwork. Form 144 filings offer a rare window into the intentions of those who know a company best—its executives, directors, and major shareholders. These are the people who sit in board meetings, review quarterly results before they're public, and shape corporate strategy.

The Players: Who Files Form 144?

Not everyone who sells stock needs to file Form 144. This requirement applies to specific categories of sellers dealing with restricted or control securities:

The Anatomy of Form 144: What's Inside?

Form 144 might seem like just another regulatory document, but each section tells part of a larger story. Here's what insiders must disclose:

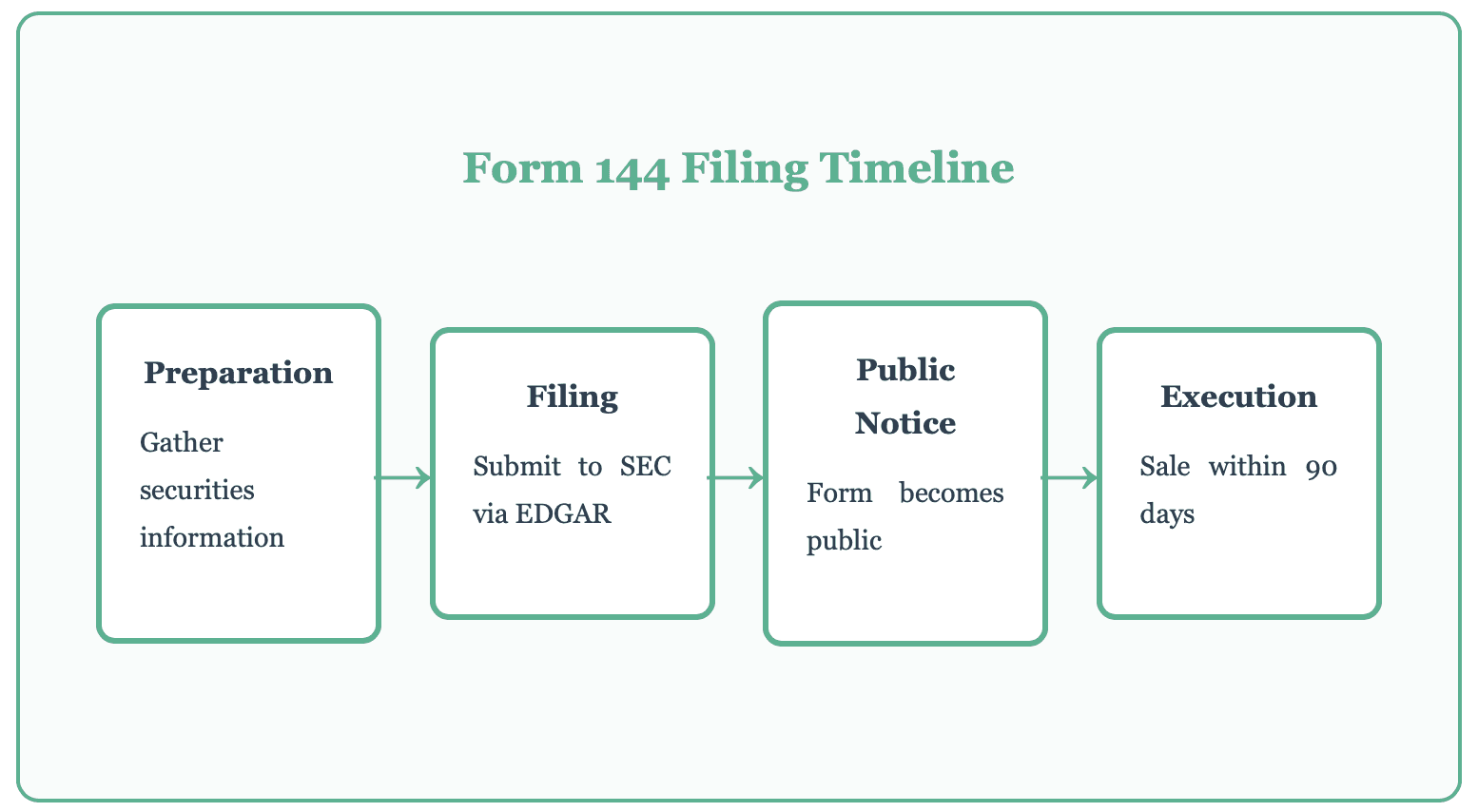

The Filing Process: How It Actually Works

The process is more nuanced than simply filling out a form. Here's the real-world flow:

Timing is crucial: The form must typically be filed concurrently with the sale or within a specified timeframe afterward, depending on the circumstances.

Electronic filing: All submissions go through the SEC's EDGAR system, making them immediately accessible to the public.

Volume limits apply: Rule 144 imposes restrictions on how much can be sold within a three-month period—generally the greater of 1% of outstanding shares or the average weekly trading volume.

Holding period matters: For restricted securities, sellers typically must hold them for at least six months (for reporting companies) or one year (for non-reporting companies) before selling.

Rule 144: The Legal Framework Behind the Form

Form 144 doesn't exist in isolation—it's the practical application of SEC Rule 144, a cornerstone regulation that governs how restricted and control securities can be sold. Think of Rule 144 as the rulebook and Form 144 as the scorecard.

Key Requirements Under Rule 144:

Current Public Information: For sales of securities of reporting companies, adequate current public information about the issuer must be available. This typically means the company is current with its SEC filing obligations.

Holding Period: Restricted securities must be held for a minimum period before resale. This prevents immediate flipping of securities acquired in private transactions.

Volume Limitations: The amount that can be sold during any three-month period is capped, preventing large, destabilizing sales.

Ordinary Brokerage Transactions: Sales must be handled in routine broker transactions, with no special solicitation or payment above normal commissions.

Notice of Sale: This is where Form 144 comes in—filing the notice with the SEC when required.

Why Insiders File: The Real Motivations

The million-dollar question (sometimes literally): Why do insiders sell their stock? The motivations are far more complex and often more benign than market cynics might suggest.

Legitimate Reasons for Insider Sales:

When Sales Raise Red Flags:

Not all insider selling is created equal. Certain patterns should catch investor attention:

Multiple executives selling simultaneously

Sales representing a large percentage of an insider's holdings

Sales shortly before negative news or poor earnings

Unusual selling patterns compared to historical behavior

Sales outside of established trading plans

The Market Impact: Reading Between the Lines

Form 144 filings don't just represent legal compliance—they're market signals that sophisticated investors monitor closely. But interpreting these signals requires nuance.

Academic studies have found that following insider purchases can generate modest positive returns, while insider sales show weaker predictive power for stock performance. The key is looking at the full picture—who's selling, how much, and under what circumstances.

The Technology Revolution: Tracking Form 144 Today

Gone are the days when investors had to manually comb through SEC filings. Today's technology has democratized access to insider trading data:

Real-time alerts: Services notify investors the moment a Form 144 hits the SEC database

Pattern recognition: AI tools identify unusual selling patterns across industries

Historical analysis: Databases track years of insider behavior, revealing long-term patterns

Comparative metrics: Tools benchmark individual filings against industry norms

This technological transformation means retail investors now have access to the same insider trading data that was once the exclusive domain of Wall Street professionals.

The Bigger Picture: Form 144 and Market Transparency

Step back from individual filings, and Form 144 reveals something profound about modern financial markets: the ongoing effort to level the playing field between insiders and ordinary investors.

Before regulations like Rule 144 and disclosure requirements existed, corporate insiders could trade with virtual impunity, profiting from information unavailable to the public. Today's framework—imperfect as it may be—represents decades of regulatory evolution designed to make markets fairer.

Form 144 serves as both transparency tool and market signal, a small but significant piece of the broader securities regulation puzzle. It acknowledges that information asymmetry will always exist between insiders and outsiders, but mandates that when insiders act on their position, they must do so in the light of day.

Looking Forward: The Future of Insider Trading Disclosure

As markets evolve, so too will disclosure requirements. Current discussions in regulatory circles include:

Shorter filing windows for greater real-time transparency

Enhanced disclosure around Rule 10b5-1 trading plans

Stricter rules around option exercise and immediate sale

Greater scrutiny of family member and entity transactions

Technology will continue transforming how Form 144 data is accessed and analyzed. Machine learning algorithms may soon predict market impact from filing patterns, and blockchain technology could create immutable, real-time disclosure systems.

Conclusion: The Untold Story, Now Told

Form 144 may never dominate financial headlines, but it represents something essential: a commitment to market fairness in a system where some will always know more than others. It's a reminder that in modern capital markets, information wants to be free—or at least disclosed.

For insiders, Form 144 is a regulatory necessity, a box to check before converting company equity into liquid wealth. For investors, it's a window—imperfect and sometimes cloudy—into the actions and potentially the mindset of those running the companies they've invested in.

The next time you see a Form 144 filing, remember: you're not just looking at paperwork. You're seeing the intersection of corporate governance, securities law, market psychology, and personal finance, all documented in a single regulatory form. That's a story worth understanding.