Back

Renewing the American Promise:The Policy Theory Behind the INVEST Act's Deregulation Push

Gana Misra

Dec 11, 2025

SEC

In the corridors of Capitol Hill, a bipartisan revolution is quietly taking shape. The Incentivizing New Ventures and Economic Strength Through Capital Formation Act—better known as the INVEST Act—represents one of the most ambitious attempts in recent years to reimagine how America's capital markets serve entrepreneurs, small businesses, and everyday investors.

The Problem: A Capital Formation Crisis

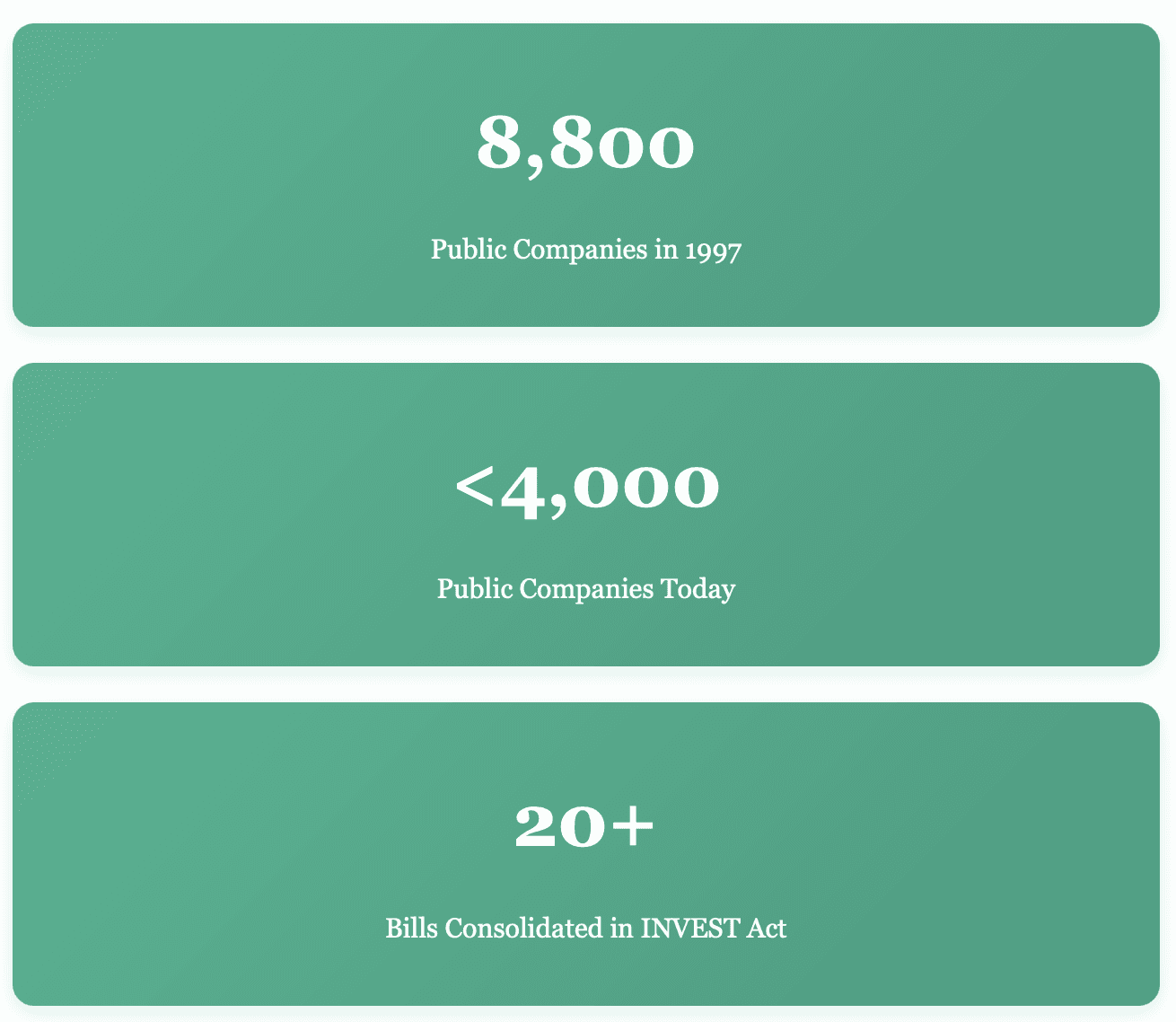

The numbers tell a sobering story. Since 1997, the number of publicly traded companies in the United States has plummeted from 8,800 to fewer than 4,000 today. This dramatic decline reflects not just changing business preferences, but a regulatory environment that has made going public increasingly burdensome and expensive.

Meanwhile, venture capital and private equity funding flows predominantly to a handful of coastal cities, leaving entrepreneurs in the Midwest, South, and rural America struggling to access the capital necessary for growth and job creation. This geographic disparity isn't just inefficient—it's fundamentally at odds with the American promise of opportunity for all.

The Philosophy: Smart Deregulation, Not Reckless Abandonment

The INVEST Act doesn't advocate for throwing caution to the wind. Instead, it embodies a more nuanced philosophy: that regulations should be proportionate to risk, adaptable to company size, and focused on genuine investor protection rather than bureaucratic compliance.

This approach reflects a growing consensus that regulatory frameworks established in the aftermath of the 1929 market crash and refined over decades may have overshot their mark, creating barriers that harm more than they help. The key insight: not all companies pose the same risks, and regulations should reflect these differences.

The Three Pillars of Reform

Title I: Empowering Small Business and Startups

The first pillar focuses on removing obstacles that prevent small businesses and startups from accessing capital markets. Key provisions include:

Expanding SEC Advocacy

Broadening the Office of the Advocate for Small Business Capital Formation to include rural entrepreneurs and creating dedicated Small Business offices within key SEC divisions.

Relaxing General Solicitation Rules

Allowing startups to present to states, public agencies, angel investors, universities, and accelerators without violating federal restrictions.

Raising Crowdfunding Thresholds

Increasing the accountant review threshold from $100,000 to $250,000 (with discretion up to $400,000), making crowdfunding more viable for growing businesses.

Expanding Venture Capital Access

Doubling the investor cap for qualifying venture capital funds from 250 to 500 people and raising their capital limit from $10 million to $50 million.

Title II: Democratizing Investment Access

Perhaps the most philosophically interesting aspect of the INVEST Act is its reconceptualization of who should be allowed to invest in private markets. Currently, the "accredited investor" definition relies almost entirely on wealth thresholds—you need a net worth exceeding $1 million or annual income above $200,000.

Critics have long argued this approach is both paternalistic and arbitrary. Why should financial sophistication be assumed based solely on wealth rather than knowledge, education, or professional expertise?

The INVEST Act addresses this by expanding the accredited investor definition to include individuals with professional brokerage or investment adviser licenses, relevant financial education or job experience, and those who pass a newly created SEC certification exam. This knowledge-based approach could open private market investing to millions of Americans currently excluded.

Additional provisions in this section include:

Allowing 403(b) retirement plans—used primarily by teachers and nonprofit employees—to invest in the same products as 401(k) plans, including collective investment trusts

Establishing a Senior Investor Taskforce at the SEC to combat fraud targeting Americans over 65

Enabling electronic delivery of investor documents as the default, reducing costs while preserving paper options

Title III: Revitalizing Public Markets

The third pillar tackles the decline in public company listings by reducing compliance burdens that disproportionately affect smaller firms. These reforms recognize that excessive disclosure requirements can actually harm investors by discouraging companies from going public, thereby reducing investment options.

The Theoretical Foundation: Proportionality and Materiality

At its core, the INVEST Act rests on two interrelated principles that deserve deeper examination.

Proportionality holds that regulatory requirements should scale with company size and complexity. A startup with five employees and $2 million in revenue shouldn't face the same disclosure regime as a Fortune 500 corporation. This principle acknowledges that one-size-fits-all regulation often fails both small businesses (which are over-regulated) and large corporations (which may be under-regulated in specific areas).

Materiality insists that disclosure requirements should focus on information that genuinely affects investment decisions. SEC Chairman Paul Atkins recently articulated this concern, noting that disclosure regimes requiring information "unmoored from materiality" do not actually benefit investors. Instead, they create compliance costs that divert resources from productive activities while overwhelming investors with irrelevant data.

The Bipartisan Appeal: Finding Common Ground

One of the most remarkable aspects of the INVEST Act is its genuine bipartisan support. In an era of intense political polarization, this legislation has attracted backing from both progressive Democrats and conservative Republicans—a testament to its careful balancing of competing interests.

Representative Gregory Meeks, a Democrat from New York, emphasized the legislation's potential to help ordinary Americans: "Today, more than half of American households have exposure to the stock market, not as day-traders or large-scale market players, but as teachers, firefighters, nurses, and workers saving for the future through mutual funds, pensions, and retirement plans like 401(k)s and IRAs. These reforms are a meaningful step toward addressing the affordability crisis and empowering people to secure their financial futures."

This framing rejects the false dichotomy between investor protection and market access. The INVEST Act's supporters argue that true investor protection means ensuring Americans can participate in wealth creation opportunities, not paternalistically limiting their choices.

Potential Challenges and Criticisms

No significant policy change comes without legitimate concerns, and the INVEST Act is no exception. Critics have raised several important questions:

Investor Protection Trade-offs: Will reducing disclosure requirements and expanding investment access expose less sophisticated investors to unacceptable risks?

Fraud Prevention: Could loosening restrictions create opportunities for bad actors to exploit less experienced investors?

Market Stability: Might an influx of smaller, less-established companies in public markets increase volatility?

Unintended Consequences: Will knowledge-based accreditation actually democratize investing, or simply create new barriers favoring those with access to financial education?

These concerns deserve serious consideration. However, proponents argue that the status quo also imposes costs—in the form of reduced economic dynamism, limited investment opportunities for middle-class Americans, and geographic inequality in capital access.

The Broader Context: Deregulation in the Trump Era

The INVEST Act arrives amid a broader push for deregulation under the Trump administration. President Trump has publicly emphasized cutting regulations across energy, manufacturing, and financial sectors, arguing that reducing bureaucratic hurdles fosters economic growth, creates jobs, and enhances American competitiveness.

This broader context raises important questions about how to distinguish between beneficial regulatory modernization and potentially harmful rollbacks of essential protections. The INVEST Act attempts to thread this needle by targeting specific, well-identified inefficiencies rather than wholesale elimination of oversight.

Reimagining American Capitalism

The INVEST Act is more than a collection of technical regulatory adjustments. It represents a fundamental reconsideration of how America's capital markets should function in the 21st century. At stake is whether the United States can maintain its position as the world's premier destination for entrepreneurship and innovation, or whether regulatory ossification will gradually erode that competitive advantage.

The legislation's emphasis on geographic equity—ensuring that entrepreneurs in Des Moines and rural Mississippi have access to capital comparable to their counterparts in Silicon Valley and Manhattan—speaks to deeper questions about American opportunity and economic fairness. Similarly, its reconceptualization of investor accreditation challenges us to think more carefully about the relationship between wealth, knowledge, and autonomy.

Whether the INVEST Act succeeds will depend not just on its passage, but on implementation. Will the SEC embrace its spirit of proportionality and materiality? Will the new pathways to accredited investor status genuinely democratize access, or will new gatekeepers emerge? Will reduced disclosure requirements lead to better or worse investment outcomes?

These questions cannot be answered in advance. What we can say is that after decades of incremental regulatory additions, the INVEST Act represents a serious attempt to step back, reassess, and modernize—to ask not just what regulations we have, but what regulations we actually need.

In that sense, the INVEST Act embodies the American spirit at its best: a willingness to question inherited wisdom, a commitment to expanding opportunity, and a faith that with appropriate guardrails, innovation and enterprise can improve lives across society. Whether that faith is justified remains to be seen, but the debate itself is vital and overdue.