Back

March 18, 2026: The Section 16 Deadline Every Foreign Private Issuer (FPI) Director Must Know.

Gana Misra

Jan 23, 2026

SEC

Updates

For directors of Foreign Private Issuers navigating the complex waters of U.S. securities regulation, Section 16 of the Securities Exchange Act of 1934 presents unique challenges and critical deadlines. Unlike their counterparts at domestic U.S. companies, FPI directors operate within a specialized regulatory framework that demands particular attention as we approach this crucial March deadline.

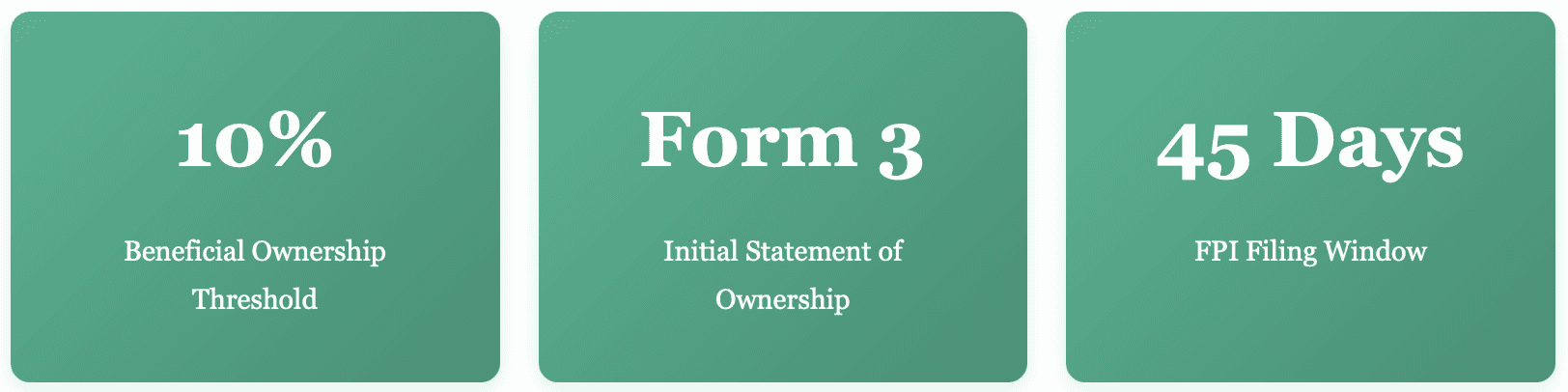

Understanding Section 16: The Foundation

Section 16 of the Securities Exchange Act serves as a cornerstone of securities regulation, designed to prevent unfair use of inside information by corporate insiders. For FPIs, this section mandates specific reporting requirements for directors, officers, and beneficial owners holding more than 10% of any class of equity securities.

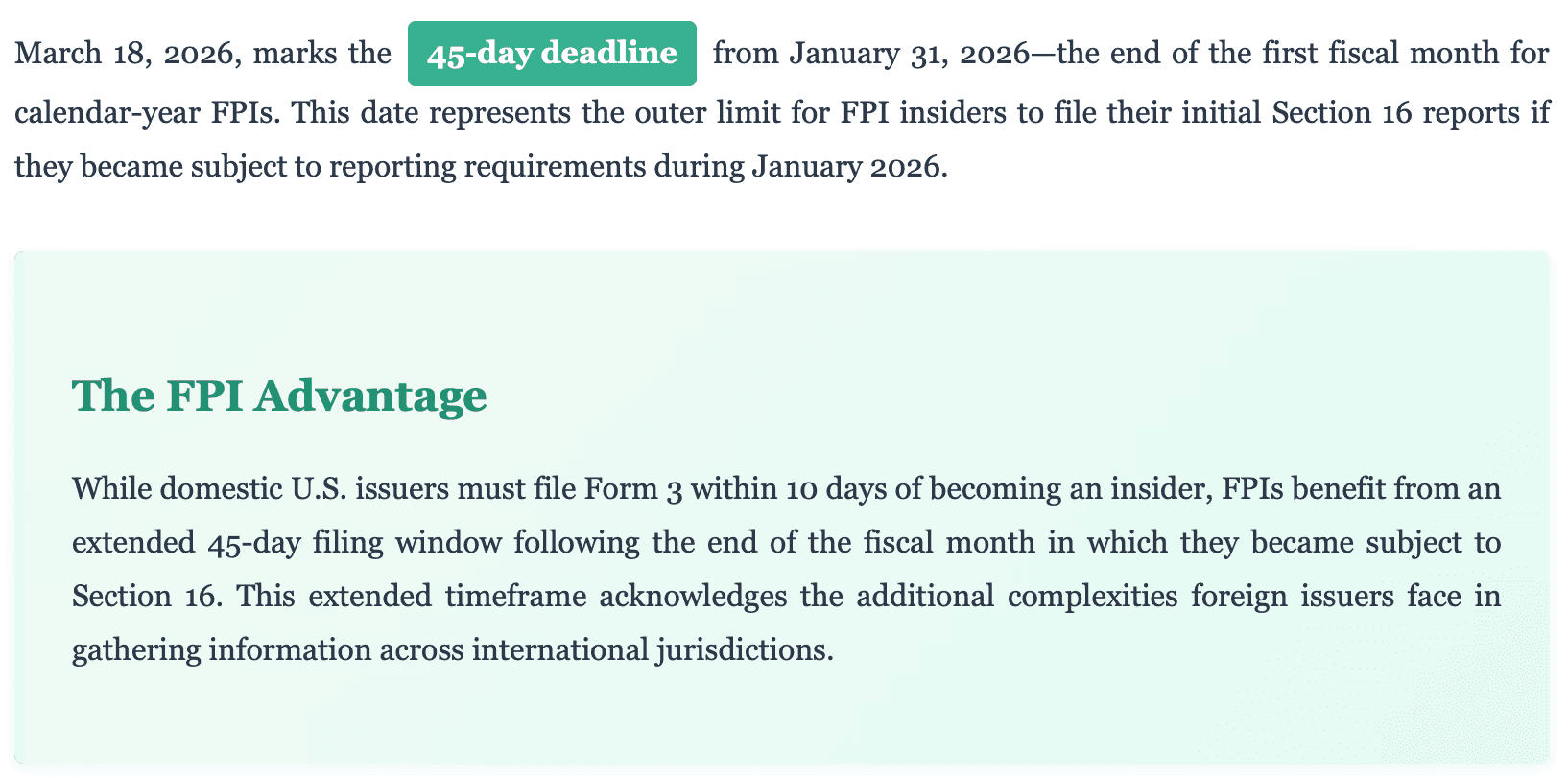

Why March 18, 2026, Matters

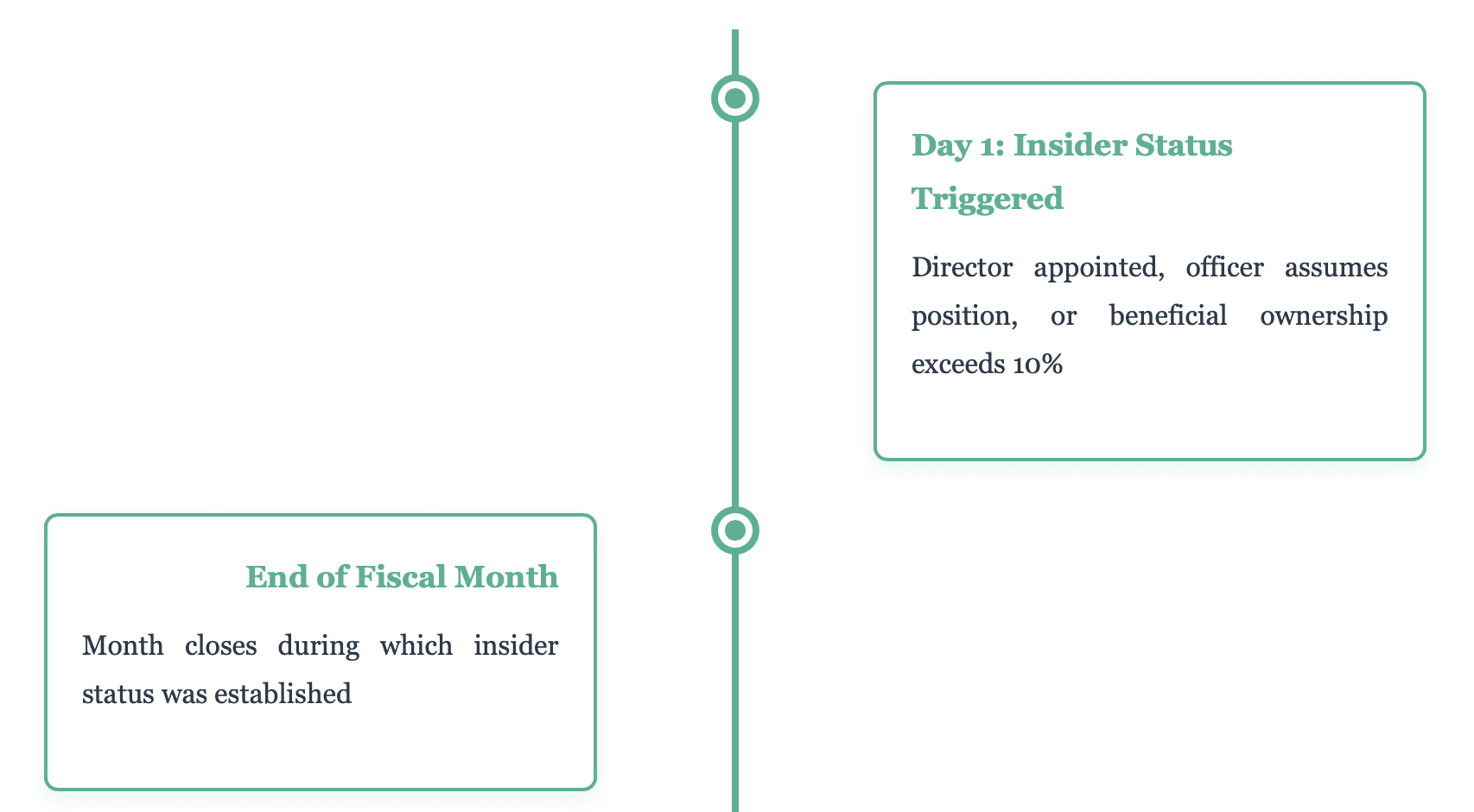

The Section 16 Reporting Timeline for FPIs

What FPI Directors Must File

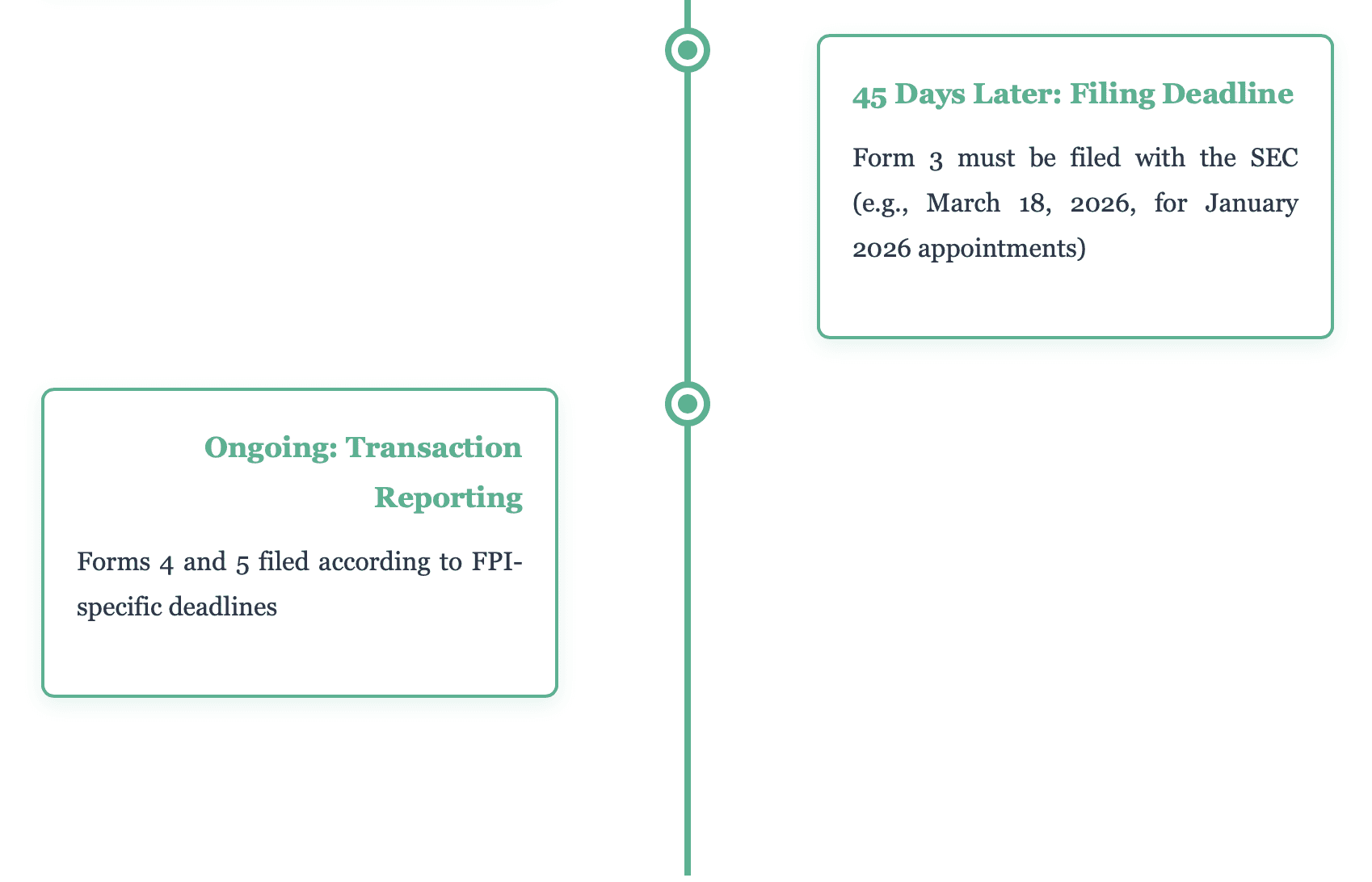

Form 3: Initial Statement of Beneficial Ownership

Form 3 serves as your introduction to the SEC's beneficial ownership tracking system. This form captures a snapshot of your equity holdings as of the date you became an insider, including direct ownership, indirect ownership through family members or trusts, and derivative securities like options or warrants.

Forms 4 and 5: Ongoing Transaction Reporting

After filing Form 3, directors must maintain ongoing compliance through Forms 4 and 5. Form 4 reports changes in beneficial ownership and must be filed within two business days of most transactions. Form 5, due within 45 days after fiscal year-end for FPIs, captures certain exempt transactions and holdings.

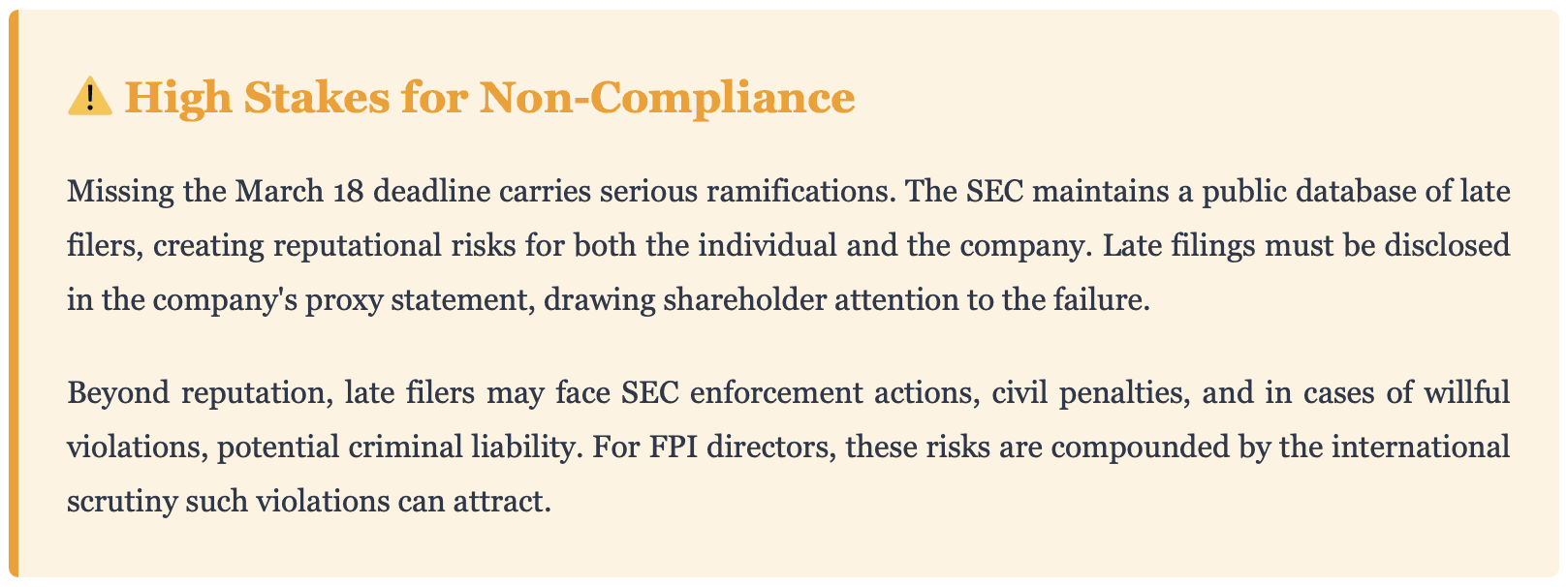

The Consequences of Missing the Deadline

Best Practices for FPI Directors

Navigating Section 16 compliance successfully requires proactive planning and systematic execution. Here's how leading FPI directors approach this critical responsibility:

1. Establish Clear Internal Protocols

Work with your company's legal and compliance teams to create standardized procedures for tracking insider appointments, collecting beneficial ownership information, and preparing Section 16 filings. Designate specific individuals responsible for monitoring deadlines and coordinating the filing process.

2. Maintain Accurate Records Year-Round

Don't wait until the deadline approaches to compile your holdings information. Maintain an ongoing record of all securities transactions, including purchases, sales, exercises of options, and receipt of equity compensation. This practice makes the filing process significantly smoother.

3. Understand Indirect Ownership Rules

Section 16 extends beyond securities you hold directly. Be prepared to disclose holdings by your spouse, minor children, and any trusts or entities where you exercise investment control. Understanding these attribution rules early prevents last-minute complications.

4. Leverage the FPI Extended Timeline Wisely

While FPIs enjoy a 45-day filing window, treat this as a maximum, not a target. Build internal deadlines that allow for review, corrections, and unexpected complications. Filing early demonstrates good governance and reduces stress.

5. Coordinate with Your Board Colleagues

Section 16 compliance works best as a coordinated effort. Share best practices with fellow directors, align on timing for routine filings, and support each other in navigating complex scenarios like equity restructurings or corporate transactions.

Special Considerations for FPI Directors

Foreign Private Issuers face unique complexities that domestic companies rarely encounter. Directors must navigate time zone differences that can complicate communication with U.S. counsel, currency conversion requirements for reporting non-U.S. transactions, and varying international disclosure norms that may conflict with SEC expectations.

Language barriers can also create challenges. While SEC filings must be in English, gathering source documentation may require working with materials in other languages. Smart FPI directors establish relationships with bilingual legal counsel who can bridge these gaps efficiently.

The Road Ahead: Post-Deadline Compliance

March 18, 2026, represents just the beginning of your Section 16 journey. Once you've filed Form 3, maintaining compliance requires ongoing vigilance. Every purchase, sale, gift, or transfer of company securities potentially triggers a Form 4 filing requirement within two business days.

Annual Compliance Checklist

Review and update your holdings records quarterly

Coordinate with company counsel before any securities transactions

File Form 4 within two business days of most transactions

Review Form 5 requirements annually (due 45 days after fiscal year-end for FPIs)

Monitor for changes in Section 16 rules and interpretations

Participate in annual compliance training

Making Section 16 Compliance Second Nature

The most successful FPI directors view Section 16 compliance not as a burden but as an integral part of their governance responsibilities. They understand that transparent reporting strengthens market confidence, protects shareholder interests, and upholds the integrity of U.S. capital markets.

By approaching the March 18, 2026, deadline with preparation, attention to detail, and a commitment to accuracy, you demonstrate the professionalism that defines effective board leadership. Whether you're a seasoned director or newly appointed, treating this deadline with the seriousness it deserves sets the foundation for exemplary compliance throughout your tenure.