Back

The "Fix-it-Later" Debt: Quantifying the Interest Rate on Uncorrected Reporting Mistakes

Gana Misra

Jan 30, 2026

Finance

Pro Tips

Why postponing corrections costs more than you think

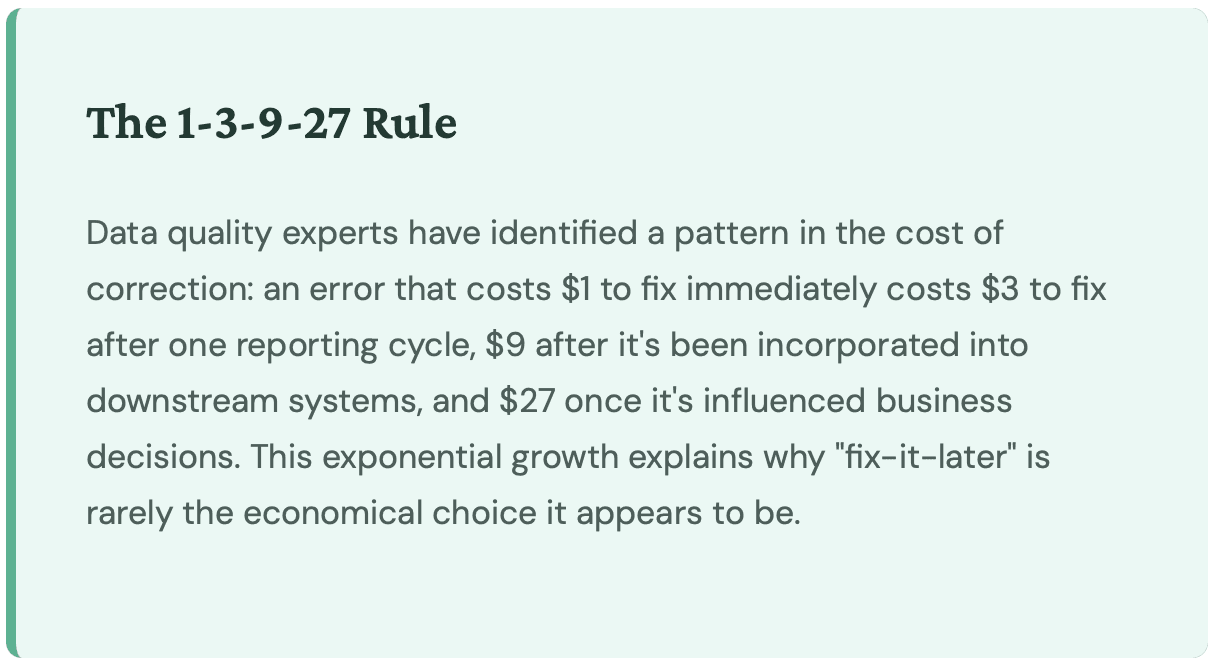

Every organization deals with reporting mistakes. A misclassified expense here, a rounding error there, perhaps a data integration hiccup that creates duplicate entries. In isolation, these seem manageable. The temptation to defer correction is strong, especially when deadlines loom and resources are stretched. But this "fix-it-later" mentality creates a unique form of technical and organizational debt that accrues interest at a rate most leaders vastly underestimate.

Understanding the Compound Effect

Unlike financial debt where interest rates are clearly stated, reporting debt compounds in less obvious but equally damaging ways. Each uncorrected mistake becomes a foundation upon which future reports, analyses, and business decisions are built. Consider what happens when a Q1 revenue figure contains a classification error that goes uncorrected.

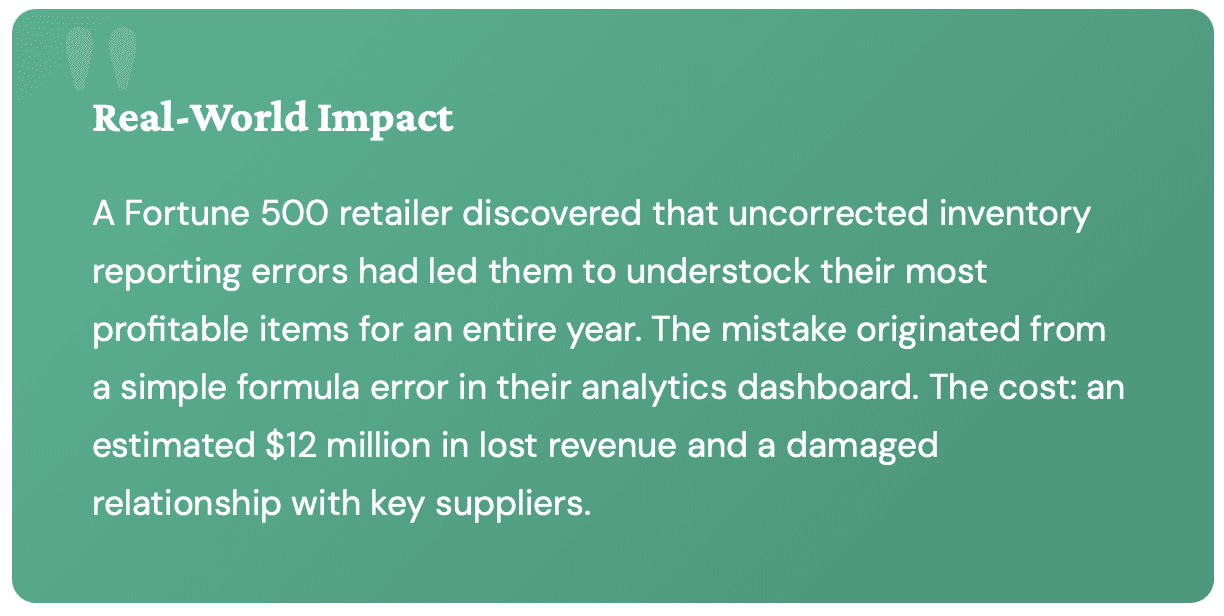

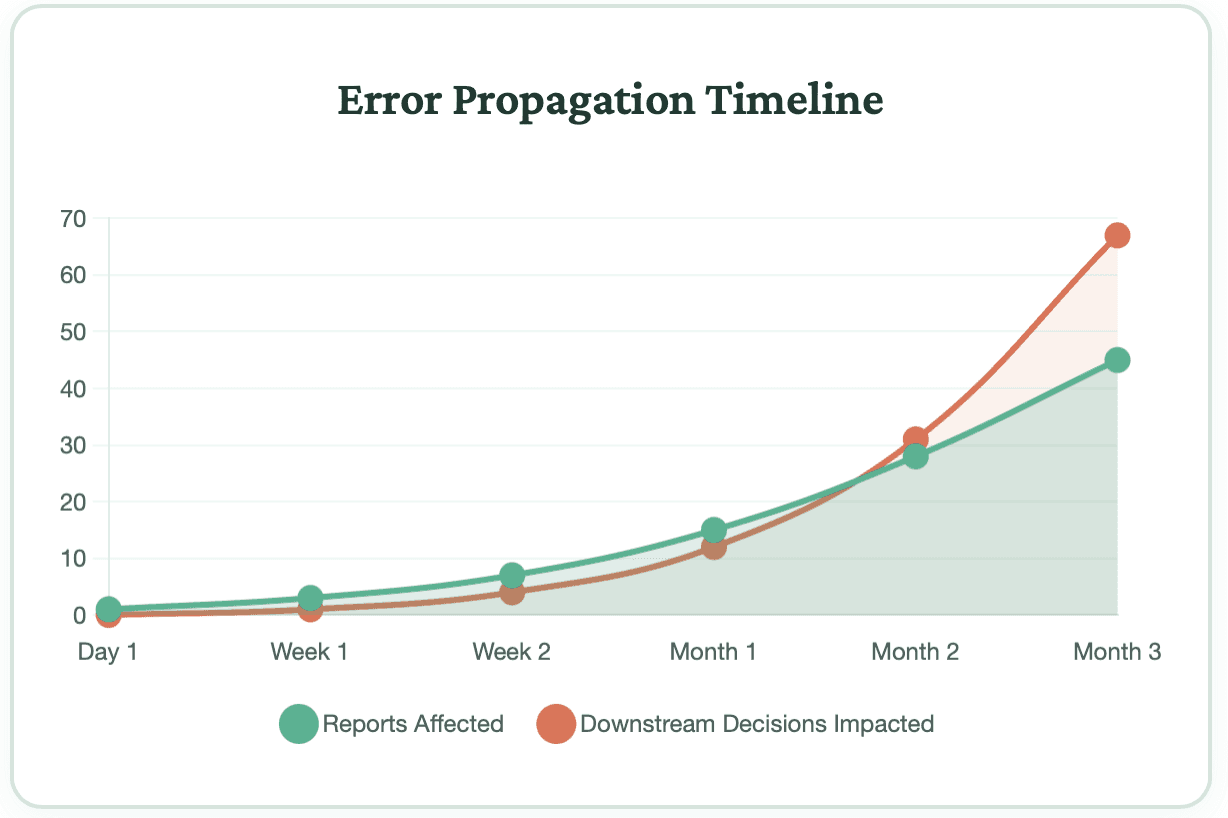

By Q2, that error has been incorporated into year-over-year comparisons. By Q3, it's affecting trend analyses and forecasting models. By Q4, strategic decisions about resource allocation have been made based on flawed data. The original error, perhaps a simple misattribution of $50,000 in revenue, has now influenced millions of dollars in business decisions.

The Hidden Interest Rates

To truly understand the cost of uncorrected reporting mistakes, we need to examine the various "interest rates" that accumulate over time. These aren't measured in percentages, but in concrete business impacts.

1. Operational Complexity Interest

Every uncorrected error adds a layer of complexity to your reporting infrastructure. Analysts must remember which reports contain which errors. Finance teams develop workarounds and manual adjustments. New employees inherit undocumented institutional knowledge about "the numbers we don't trust." This operational overhead compounds monthly, eating into productivity and increasing the likelihood of new errors.

2. Decision Quality Degradation

Perhaps the most insidious form of interest is the degradation of decision quality. When executives make strategic choices based on flawed data, the consequences ripple throughout the organization. Marketing budgets get allocated to underperforming channels. Product development resources flow to initiatives that appear more promising than they are. Hiring decisions get made based on growth trajectories that don't exist.

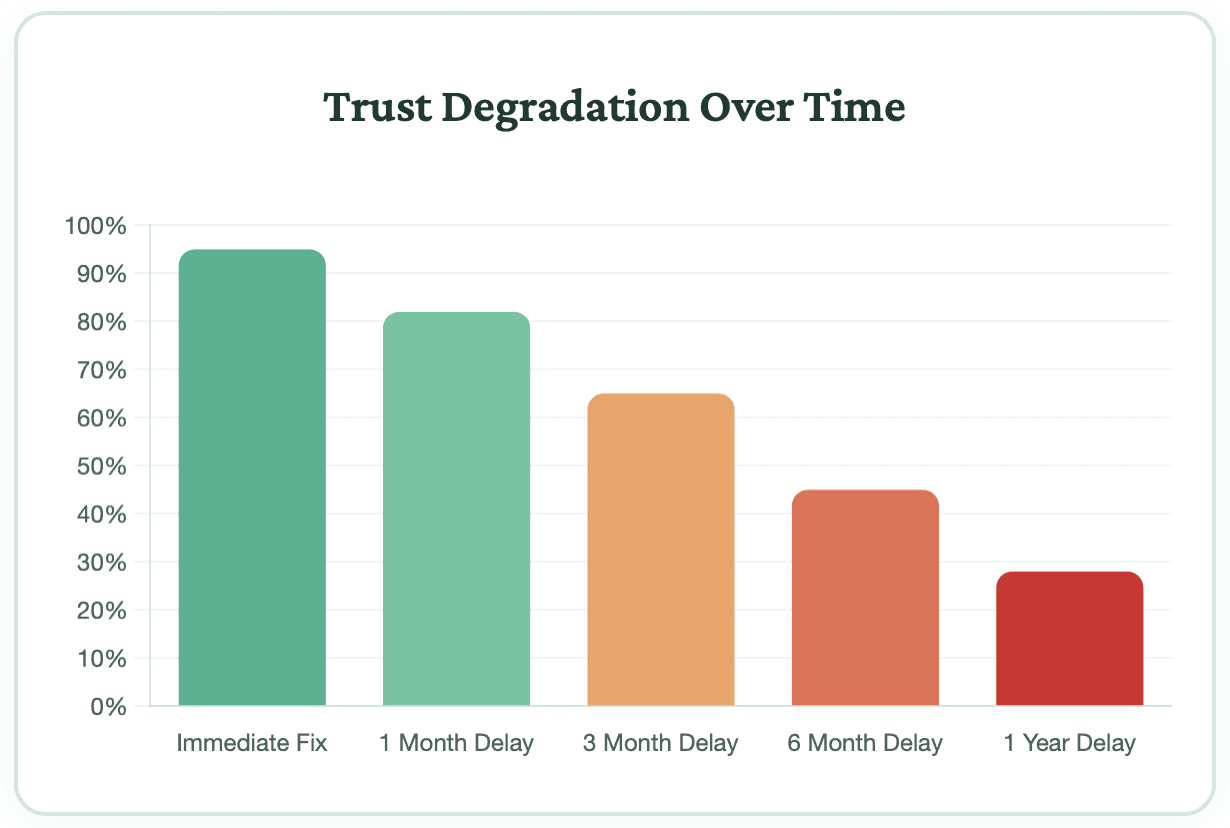

3. Trust Erosion Tax

When reporting mistakes persist, something subtle but devastating occurs: stakeholders lose trust in the data. Executives start making decisions based on gut feeling rather than reports. Department heads maintain shadow spreadsheets. The board questions every number presented. This trust erosion is perhaps the highest interest rate of all, because it undermines the entire purpose of business intelligence and reporting infrastructure.

Calculating the True Cost

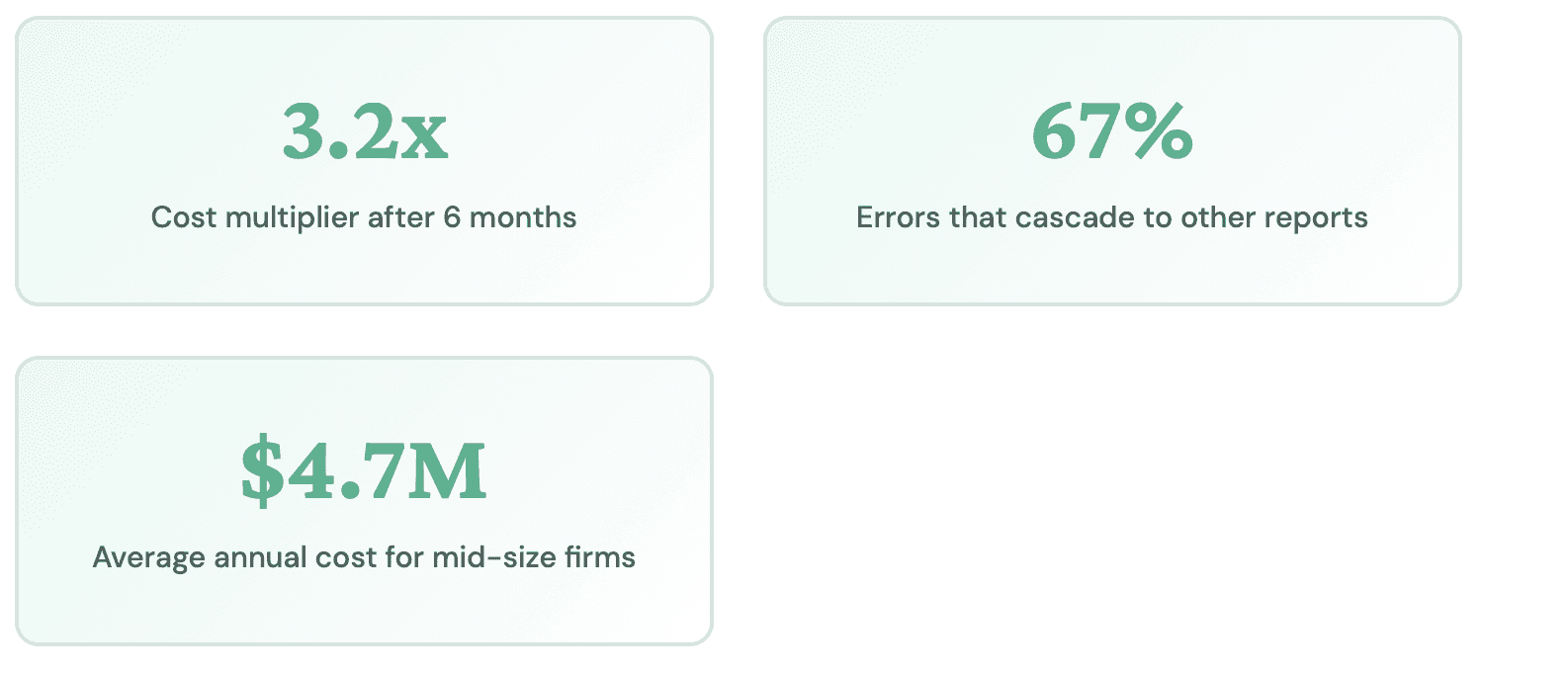

Let's break down the actual dollars and hours that accumulate when reporting mistakes go unfixed. These calculations are based on industry research and interviews with finance and analytics leaders across various sectors.

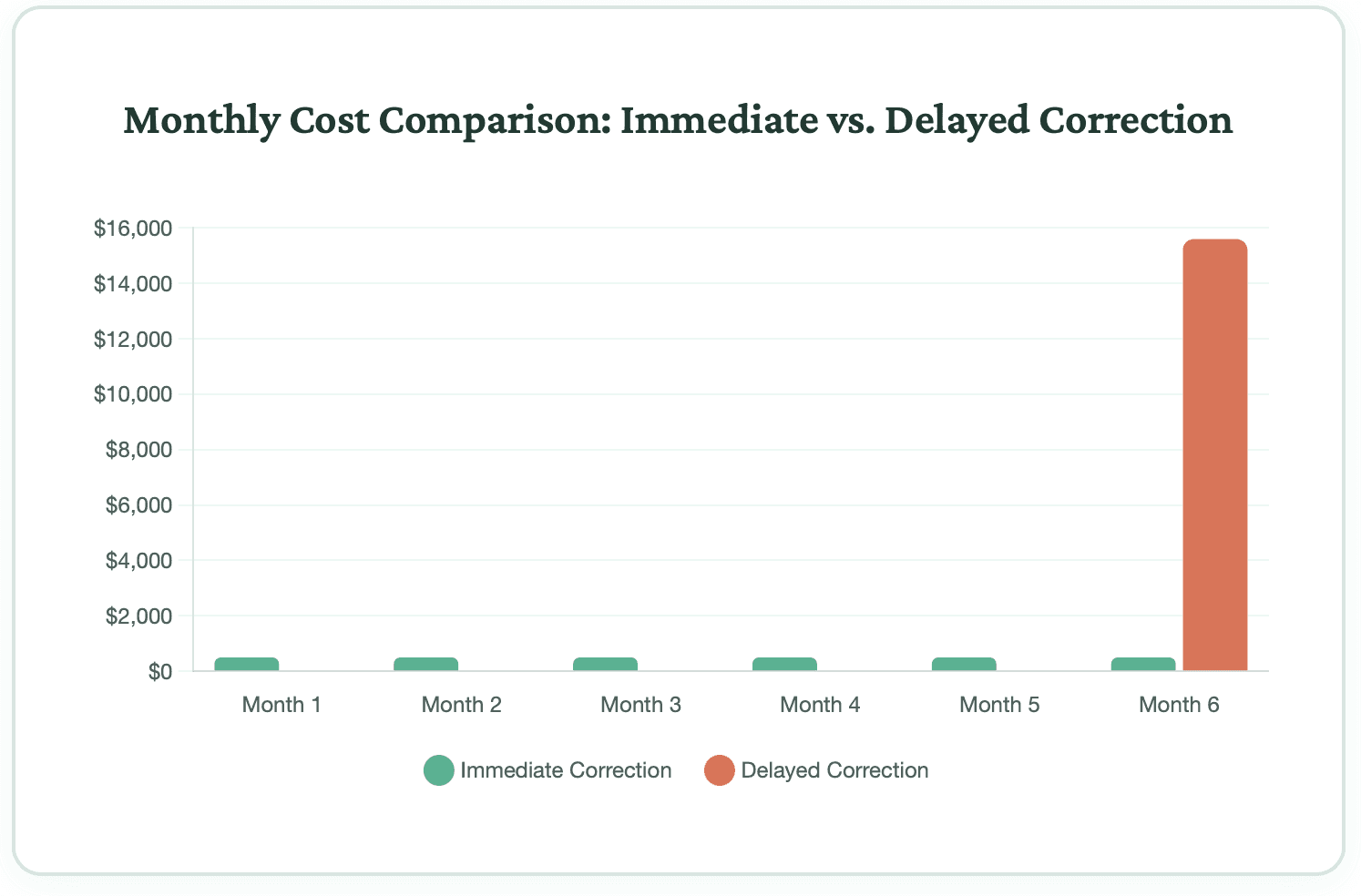

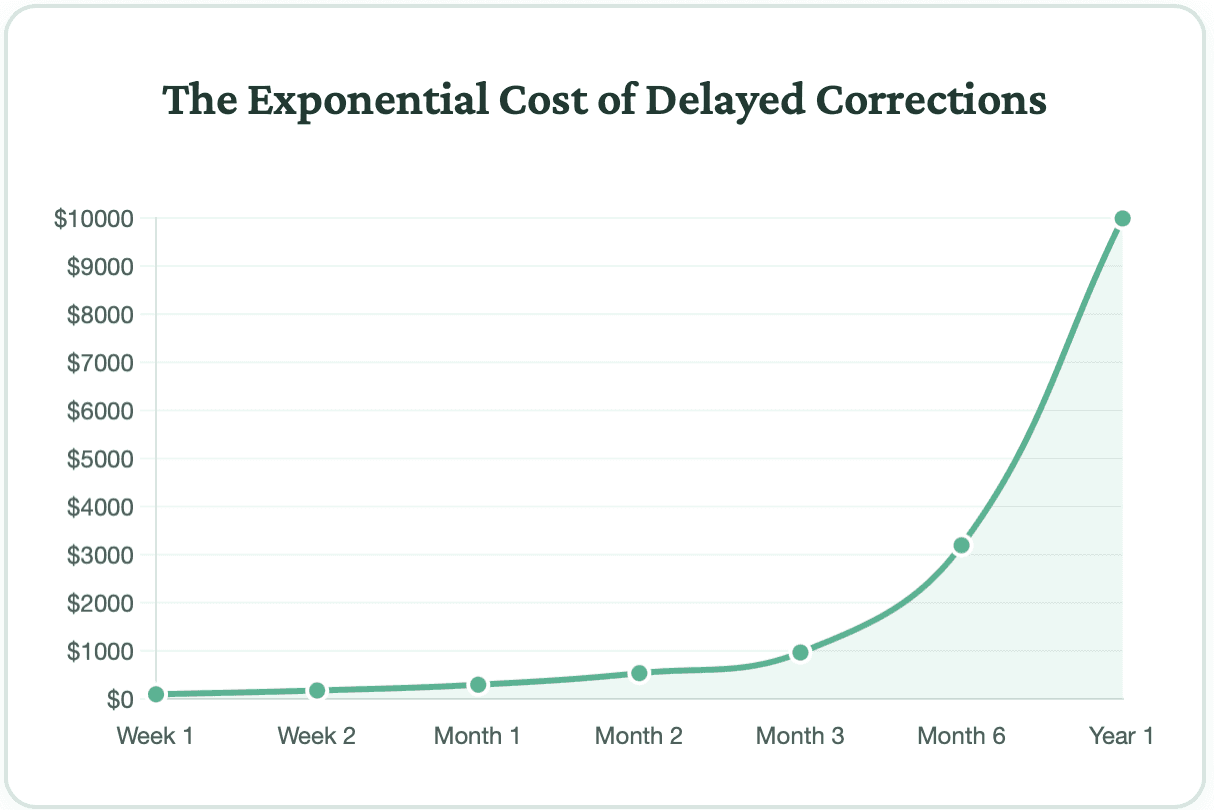

Consider the staff hours alone. An immediate correction might take an analyst 30 minutes to identify, fix, and verify. Wait a month, and now you're looking at several hours to trace the error through multiple reports, coordinate corrections, and communicate changes to stakeholders. Wait six months, and you might need a cross-functional team spending days to unravel the implications and restore confidence in the corrected numbers.

The Cascade Effect

Research shows that approximately 67% of reporting errors don't remain isolated. They cascade into other reports, dashboards, and analyses. This creates a multiplier effect where fixing the original error requires updating potentially dozens of dependent reports and recalculating metrics that were based on flawed inputs.

Breaking the Cycle

The solution isn't perfection—no reporting system will ever be error-free. Instead, organizations need to shift from a "fix-it-later" to a "fix-it-fast" mentality. This requires both cultural and systematic changes.

First, organizations must destigmatize reporting errors. When mistakes carry significant political or career risk, people naturally try to hide them or downplay their significance. Creating a culture where errors are treated as valuable feedback for improving systems rather than personal failures is essential. Some of the most mature data organizations hold regular "error retrospectives" where teams analyze mistakes without blame to identify systematic improvements.

Second, invest in detection systems that catch errors early. Automated data quality checks, reconciliation processes, and anomaly detection can identify many errors before they make it into executive reports. The cost of these systems is invariably lower than the compound cost of the errors they prevent.

Third, establish clear protocols for error correction and communication. When an error is discovered, everyone should know exactly what happens next: how it gets triaged, who approves the correction, how stakeholders are notified, and how historical reports are updated. This removes the friction that often leads to procrastination.

The ROI of Swift Correction

Companies that have implemented robust error correction processes report measurable benefits. Beyond the obvious cost savings from avoiding compound effects, these organizations see improvements in:

Decision Velocity: Executives who trust their data make decisions faster and with greater confidence.

Analytical Productivity: When analysts aren't maintaining mental maps of known errors and workarounds, they can focus on value-adding analysis.

Stakeholder Alignment: Debates about strategy become more productive when everyone trusts they're working from the same facts.

System Simplification: Addressing errors at their source often reveals opportunities to streamline overly complex reporting architectures.