Back

Quality vs. Quantity: Why Fewer Audit Inspections Don’t Mean Less Risk for Your Finance Team.

Gana Misra

Jan 19, 2026

Finance

AI

The Traditional Mindset: More is Better

For decades, finance teams have operated under a simple assumption: the more audit inspections you conduct, the safer your organization. It's an intuitive belief. After all, wouldn't checking everything multiple times catch every possible error or fraud?

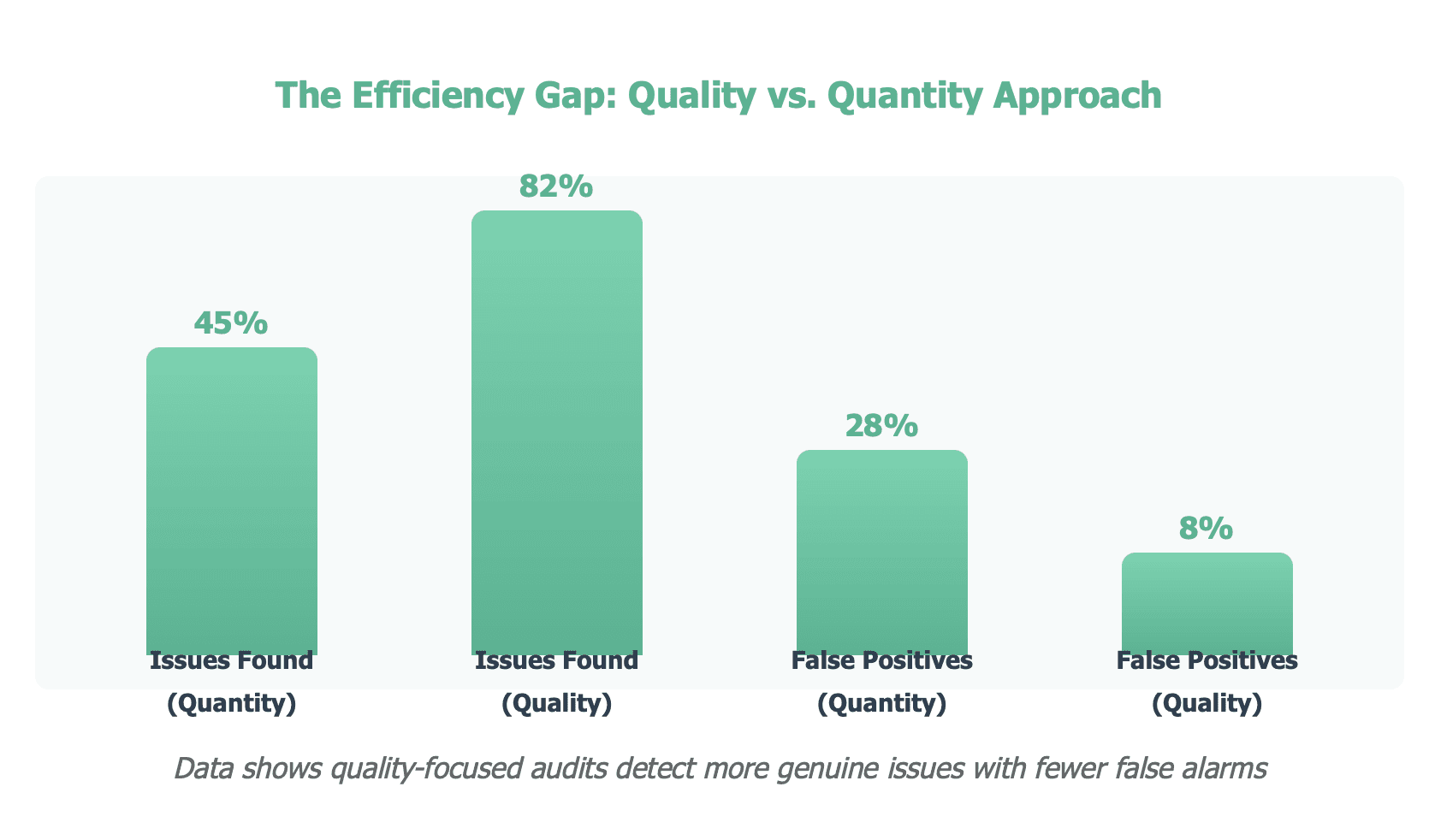

But here's the uncomfortable truth that's emerging from organizations worldwide: inspection frequency doesn't correlate with risk reduction as strongly as we once believed.

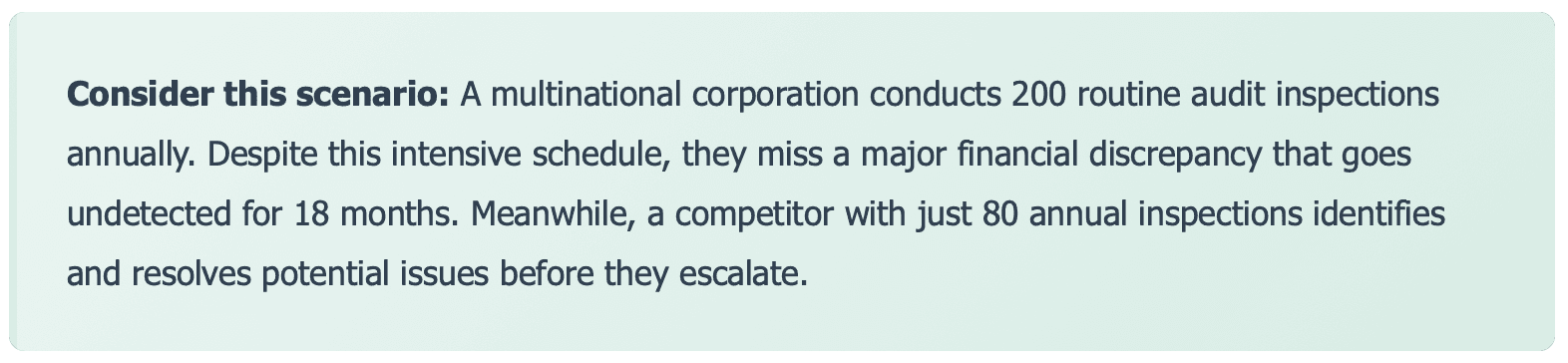

What's the difference? The answer lies not in how many inspections are performed, but in how well they're designed and executed.

Why More Inspections Can Actually Increase Risk

It sounds counterintuitive, but an overabundance of inspections can create a false sense of security while introducing new vulnerabilities:

1. Inspection Fatigue

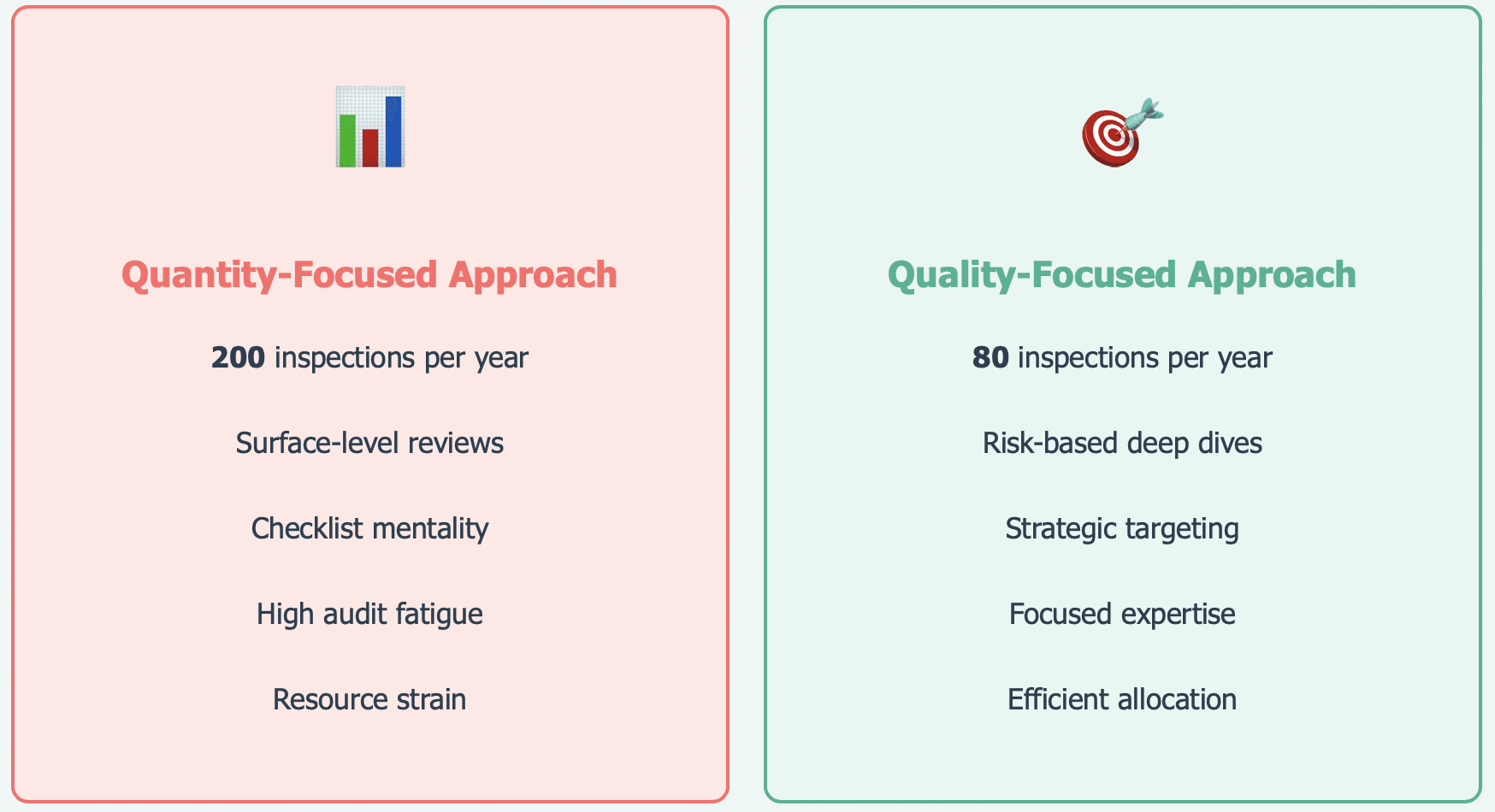

When your team is constantly being audited, something dangerous happens: they start going through the motions. The thoroughness that makes inspections valuable erodes into checkbox exercises. Auditors become desensitized, and the finance team becomes skilled at "performing" compliance rather than embodying it.

2. Resource Dilution

Every hour spent on a routine inspection is an hour not spent on strategic risk analysis, process improvement, or investigating genuine red flags. Organizations can become so busy inspecting that they lose sight of what they're inspecting for.

Real-world impact: A Fortune 500 company reduced their audit inspections by 40% while increasing their detection rate of material misstatements by 35%. How? They redirected resources toward data analytics, risk-based sampling, and specialized deep-dive audits in high-risk areas.

3. The Illusion of Coverage

Multiple shallow inspections create an illusion of comprehensive coverage. Organizations believe they're protected because "we audit that department every quarter," but if those audits are superficial, the protection is illusory.

The Quality Revolution: A New Audit Philosophy

Progressive finance teams are embracing a paradigm shift: from audit volume to audit intelligence. Here's what this transformation looks like:

Risk-Based Prioritization

Instead of spreading resources evenly, quality-focused audits concentrate on areas where risks are highest. This means:

Data analytics identify patterns and anomalies that warrant investigation

Historical trends inform where problems are most likely to emerge

Business intelligence highlights departments or processes undergoing significant change

External factors like regulatory changes or market volatility guide audit focus

Deeper, Not Broader

Quality audits go beneath the surface. Rather than checking if documentation exists, they examine whether processes are genuinely robust. Rather than verifying that controls are in place, they test whether those controls would withstand real-world stress.

Continuous Monitoring vs. Periodic Checking

Technology has enabled a shift from periodic inspections to continuous monitoring. Automated systems can flag anomalies in real-time, allowing human auditors to focus their expertise where it's most needed rather than on routine verification tasks.

Implementing a Quality-First Audit Strategy

Transitioning from quantity to quality requires both cultural and operational changes:

Step 1: Conduct a Risk Assessment

Map your organization's genuine risk landscape. Where are the vulnerabilities? What processes have the highest potential for material impact if they fail? This becomes your audit roadmap.

Step 2: Invest in Technology

Data analytics, AI-powered anomaly detection, and automated monitoring tools allow you to maintain oversight without constant manual inspection. These systems work 24/7, flagging issues that require human expertise.

Step 3: Upskill Your Team

Quality audits require different skills than quantity audits. Your team needs training in forensic analysis, data interpretation, and complex problem-solving rather than just checklist verification.

Step 4: Redefine Success Metrics

Stop measuring audit effectiveness by number of inspections completed. Instead, track:

Issues identified and prevented before they become problems

Time from issue detection to resolution

Accuracy rate of risk predictions

Stakeholder satisfaction with audit insights

Return on investment for audit resources

The Bottom Line

As finance professionals, we must challenge the outdated belief that audit frequency equals audit effectiveness. The evidence is clear: fewer, higher-quality inspections deliver better risk management outcomes.

This isn't about cutting corners or reducing oversight. It's about being strategic, intelligent, and effective in how we protect our organizations. It's about recognizing that in the modern business environment, with its complex transactions and vast data flows, human auditors can't physically inspect everything—nor should they try.

Instead, we should leverage technology for continuous monitoring, apply human expertise where it matters most, and focus our efforts on the areas where risk is genuinely elevated. That's not just more efficient—it's more effective.