Back

Audit Risks and Implementation Hurdles: What to Watch for in IFRS 18.

Gana Misra

Jan 15, 2026

Disclosures

disclosure

Finance

Updates

The International Financial Reporting Standard 18 (IFRS 18) represents one of the most significant changes to financial statement presentation in decades. Set to replace IAS 1, this new standard promises enhanced comparability and transparency. However, with great change comes great responsibility and potential pitfalls. Organizations and auditors must navigate a complex landscape of implementation challenges and audit risks.

Understanding IFRS 18: The Big Picture

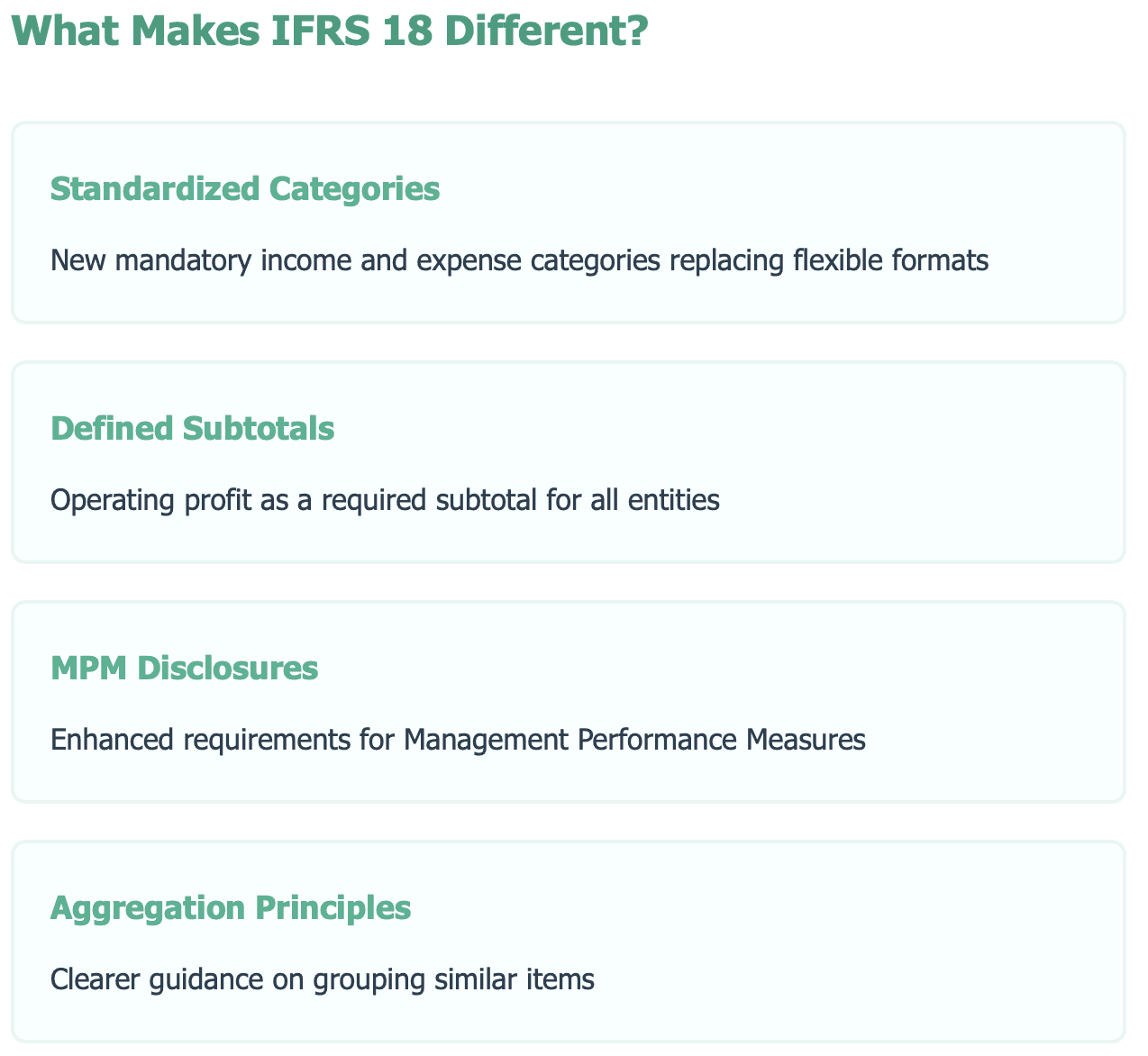

IFRS 18 introduces revolutionary changes to how companies present their financial performance. The standard mandates new categories in the statement of profit or loss, including operating, investing, and financing categories, along with defined subtotals that must be presented by all entities.

Critical Audit Risks to Monitor

1. Classification Challenges

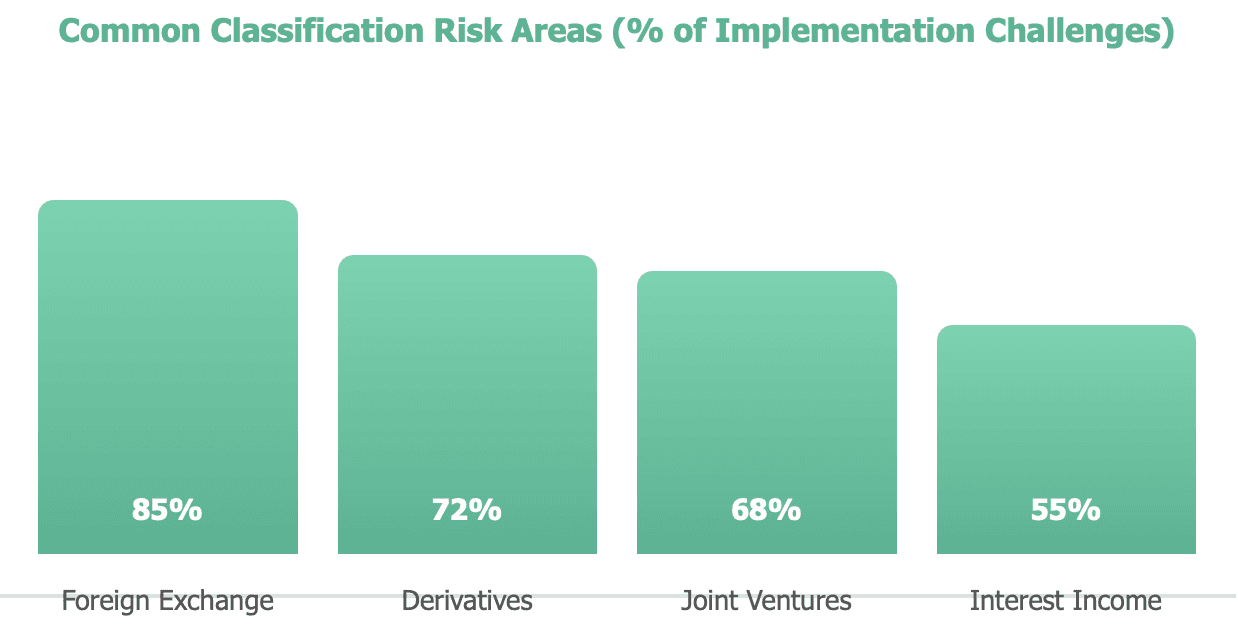

The most significant audit risk stems from the new classification requirements. Companies must categorize income and expenses into operating, investing, and financing activities based on defined criteria.

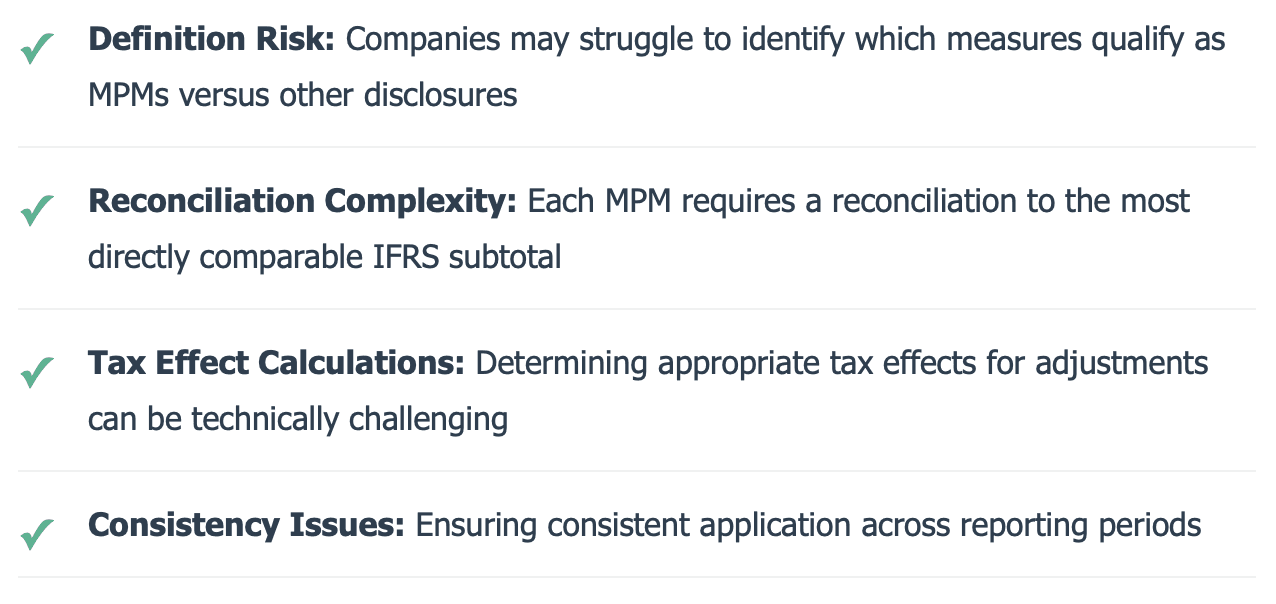

2. Management Performance Measures (MPMs)

IFRS 18 introduces stringent requirements for MPMs, which are subtotals of income and expenses that management uses to communicate its view of financial performance beyond those required by IFRS.

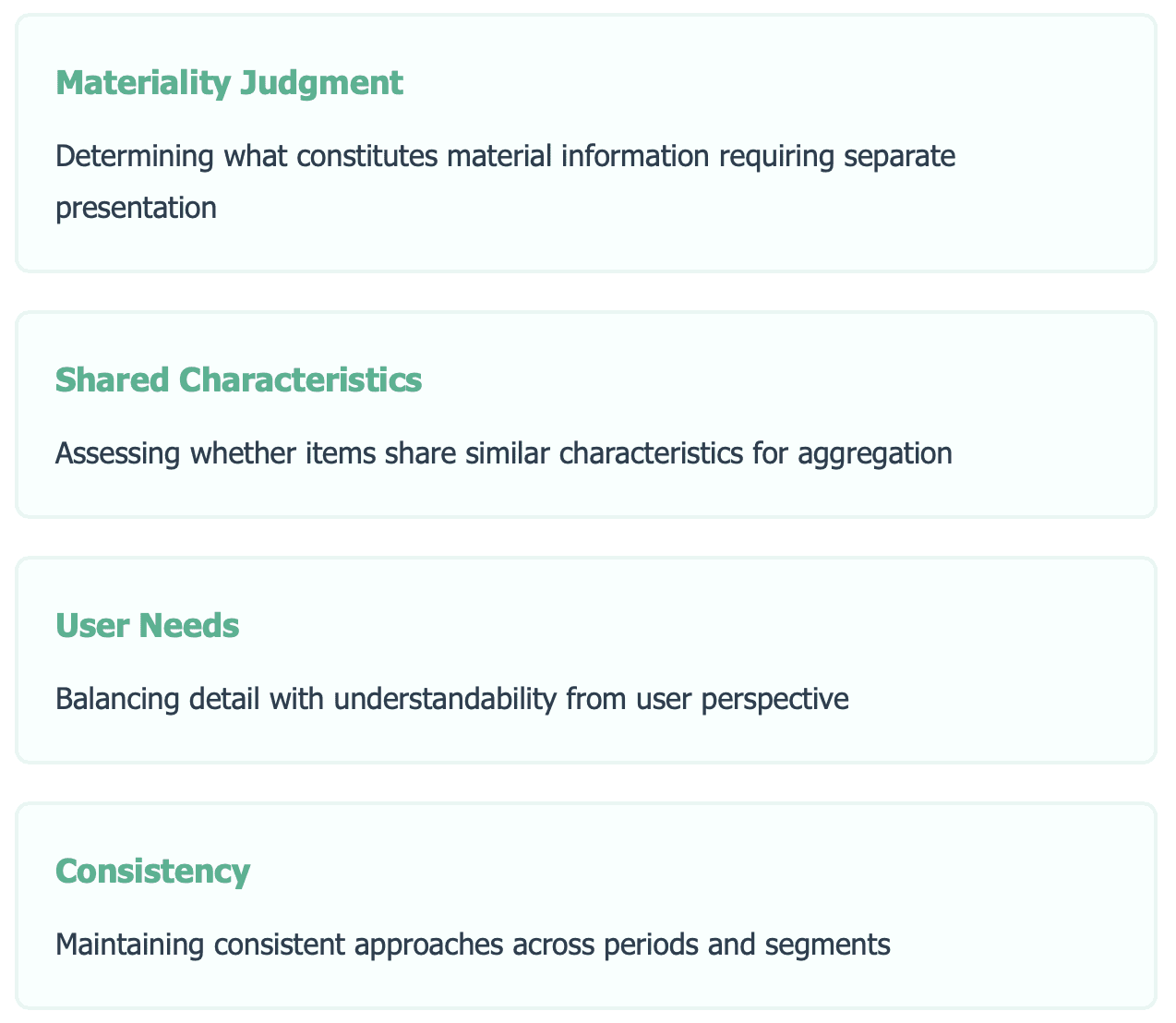

3. Aggregation and Disaggregation

The standard provides enhanced guidance on when to aggregate or disaggregate items. This seemingly straightforward requirement masks significant complexity and judgment.

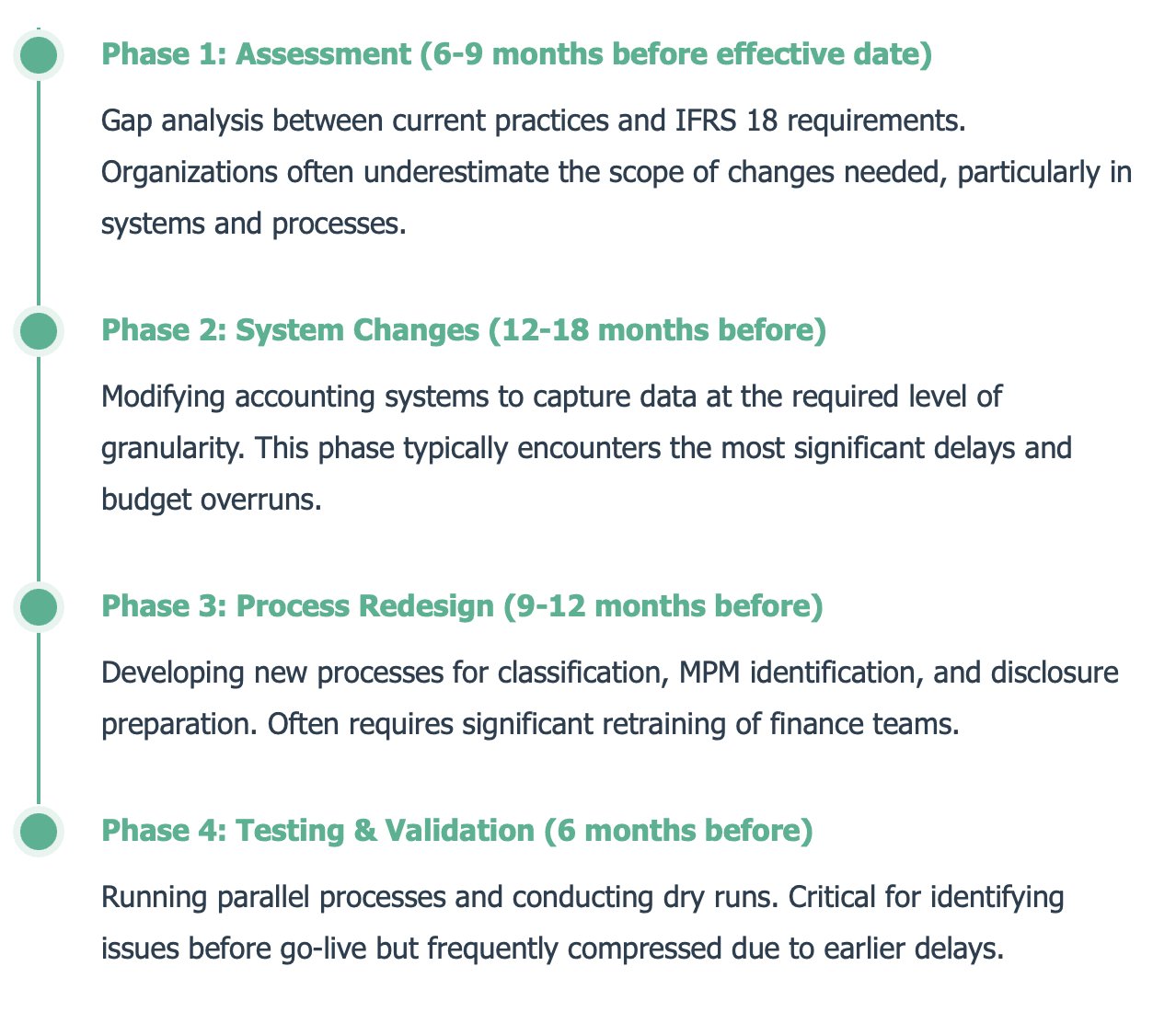

Implementation Hurdles: From Theory to Practice

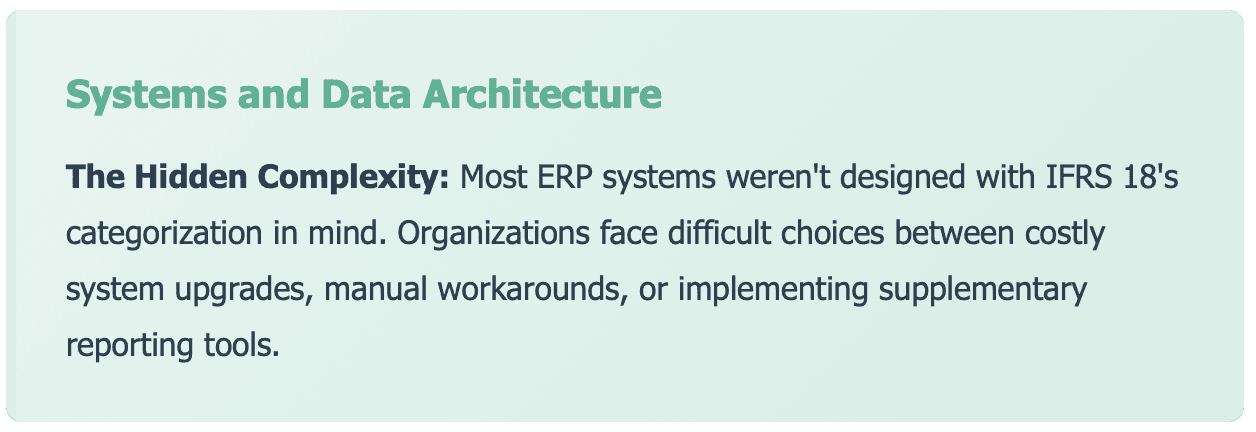

Technical Implementation Challenges

Organizational and Governance Hurdles

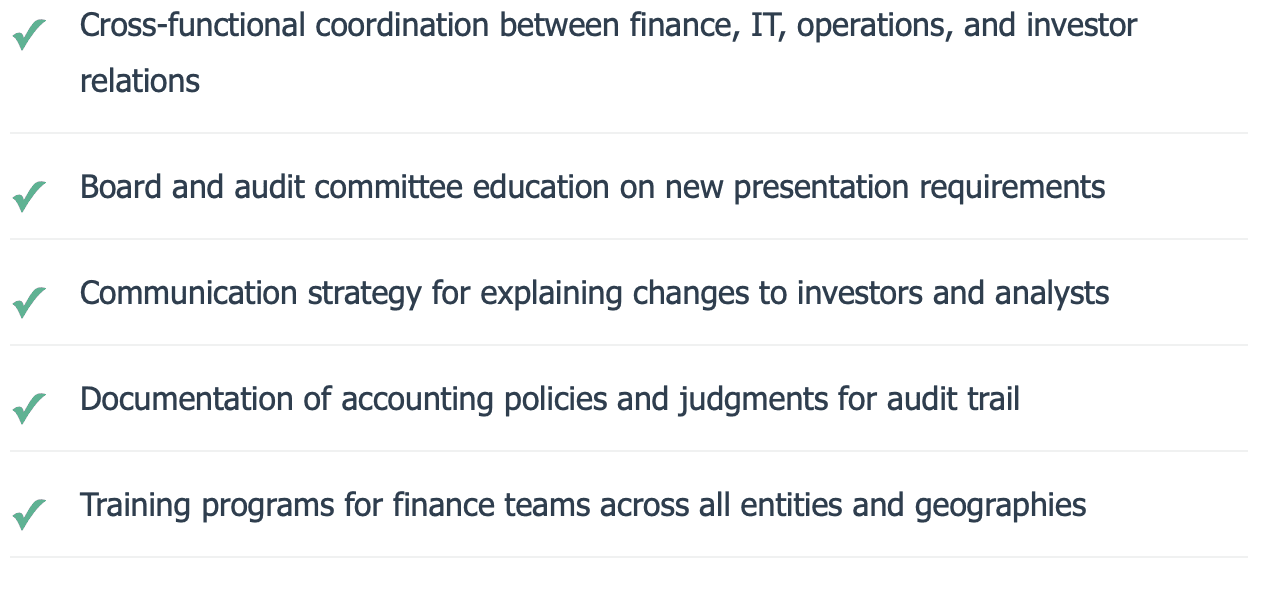

Beyond technical challenges, IFRS 18 implementation requires significant organizational change management:

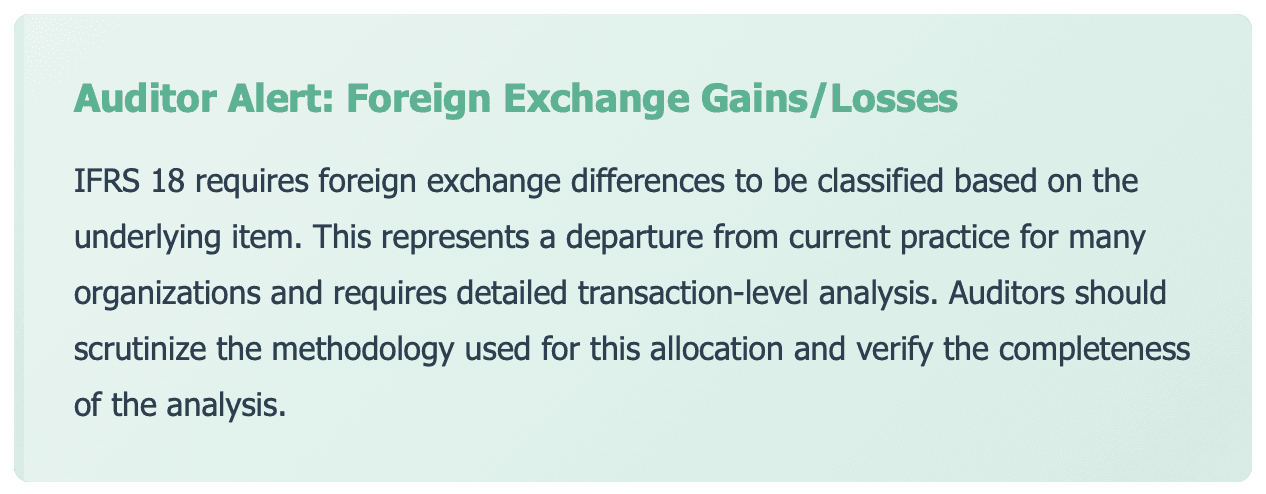

Specific Areas Requiring Enhanced Audit Scrutiny

Operating Profit Calculation

The requirement to present operating profit as a defined subtotal introduces audit risks around boundary determination. What's included in "operating" versus "investing" or "financing" requires careful judgment and consistent application.

Comparative Information Challenges

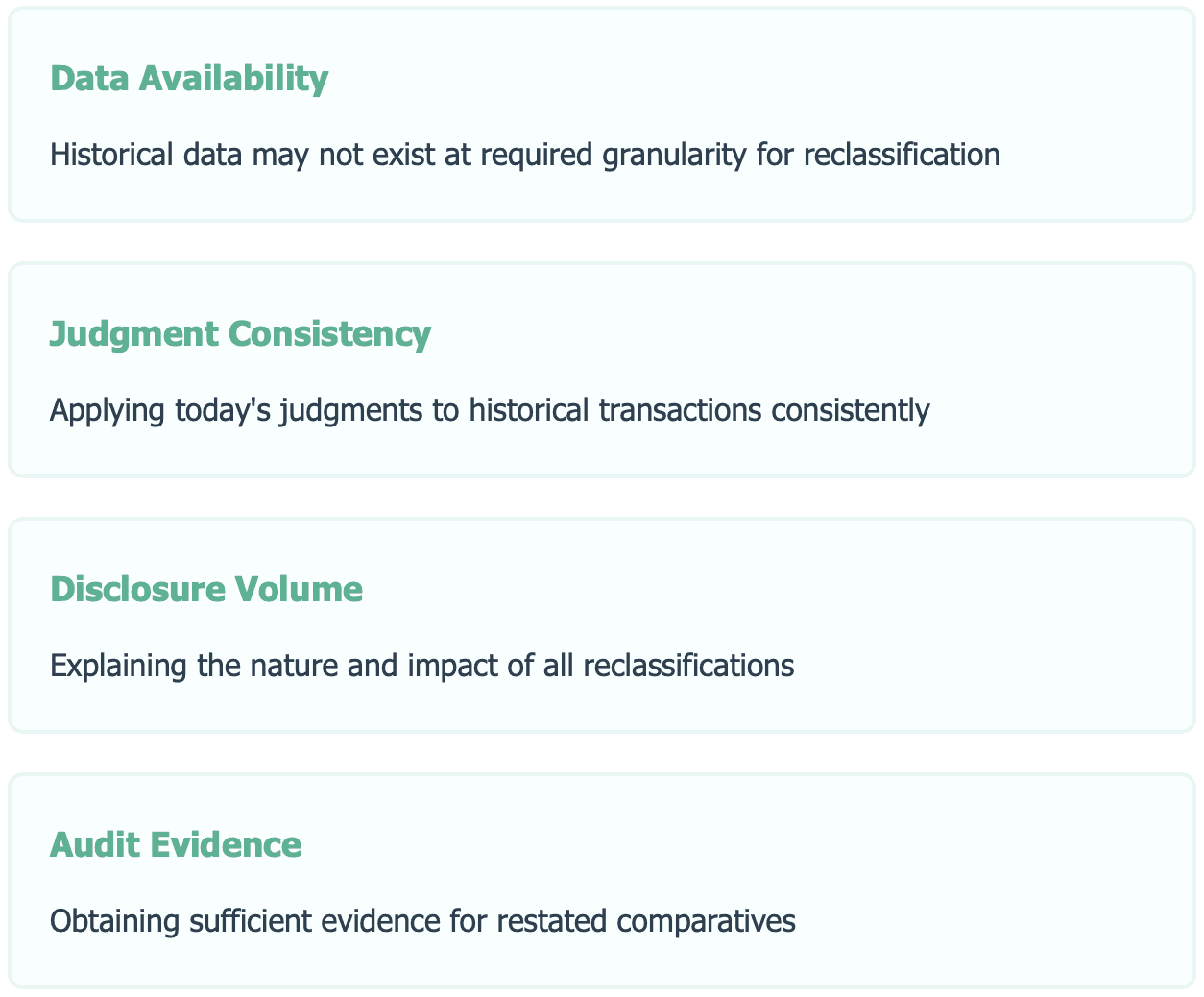

IFRS 18 requires retrospective application, meaning prior period comparatives must be restated. This creates unique audit challenges:

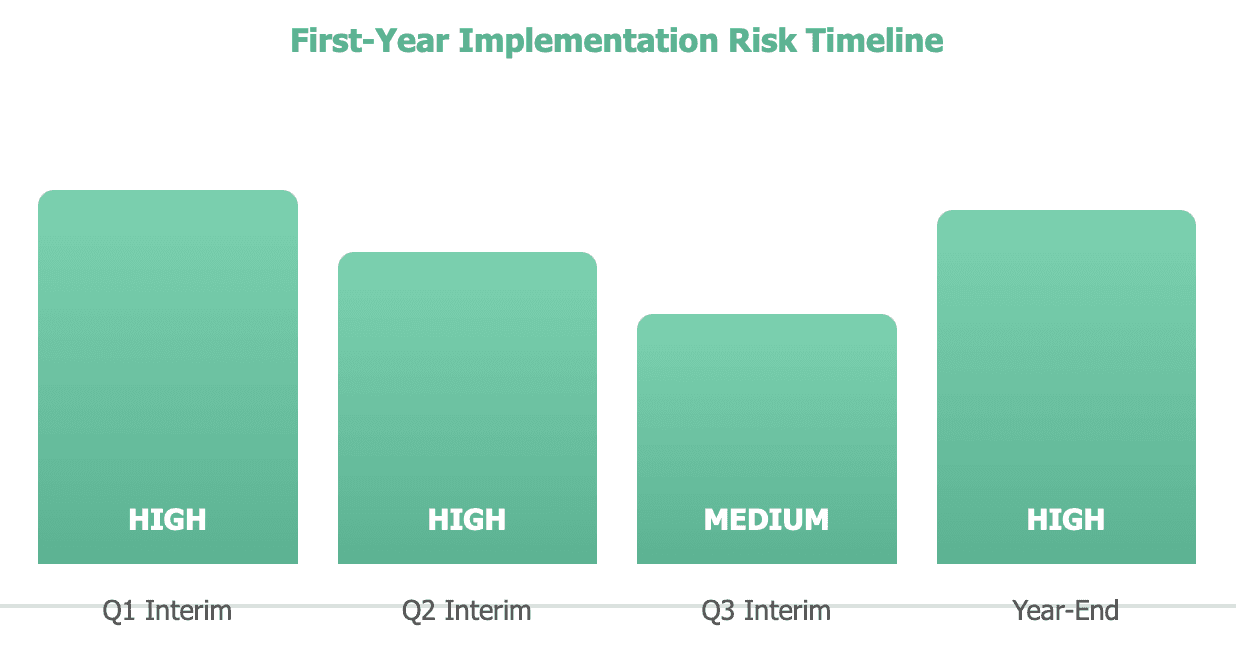

First-Time Adoption Risks

The year of first-time adoption presents amplified risks as organizations navigate the standard for the first time under real conditions.

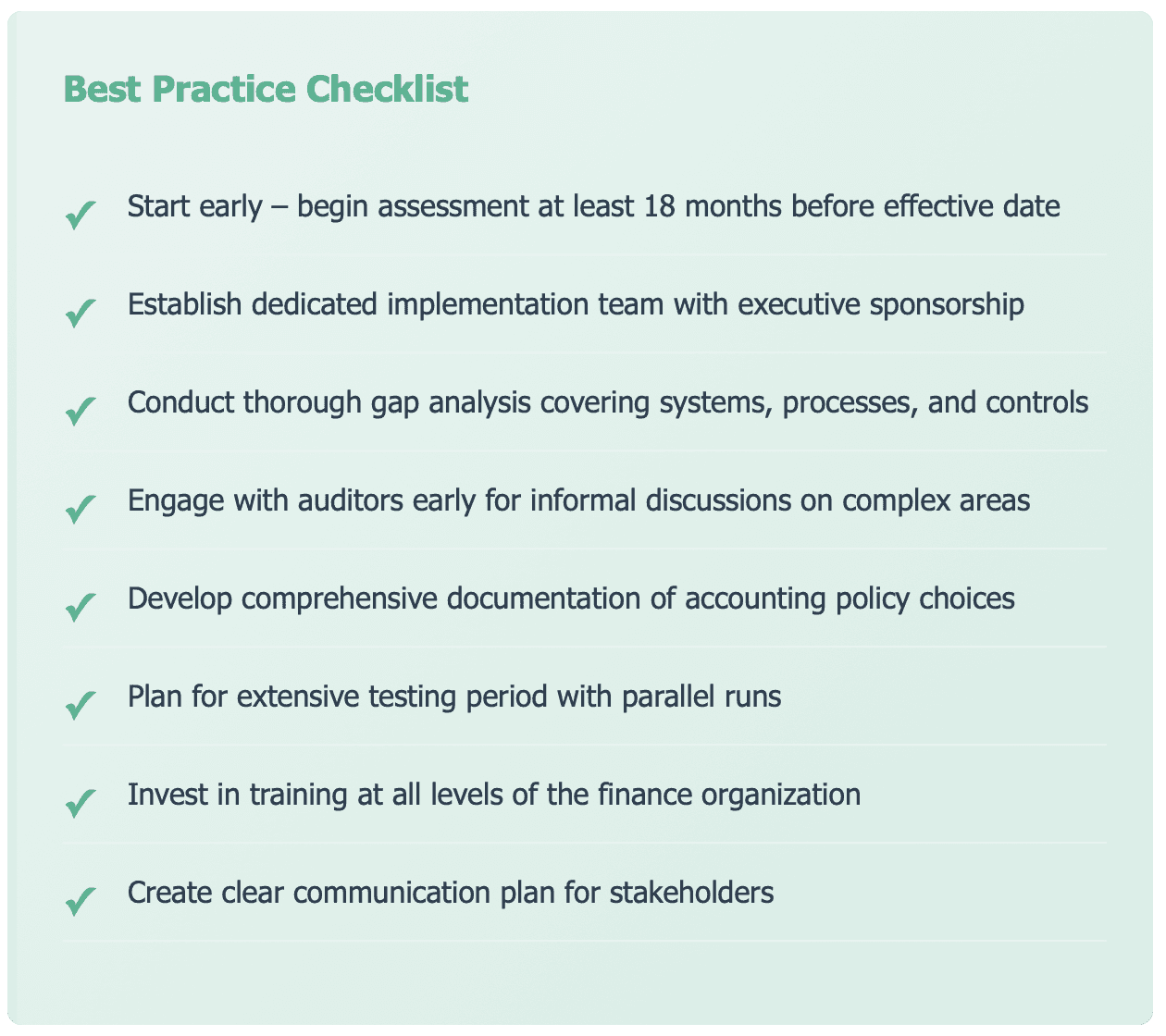

Mitigation Strategies: Preparing for Success

For Organizations

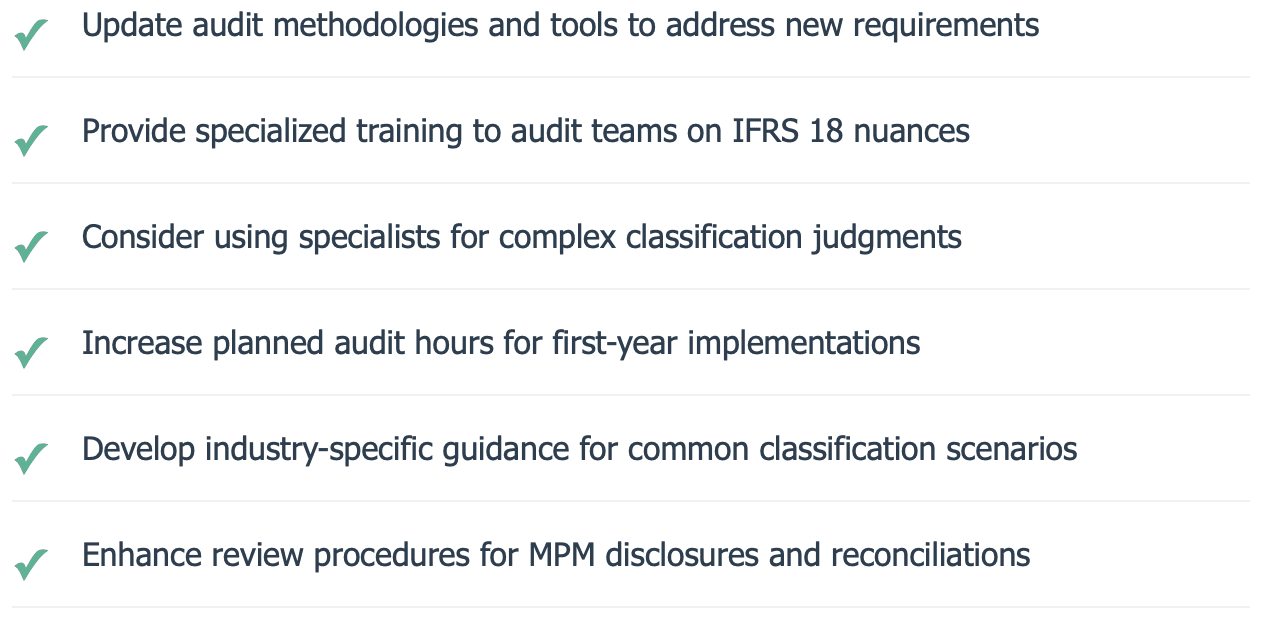

For Auditors

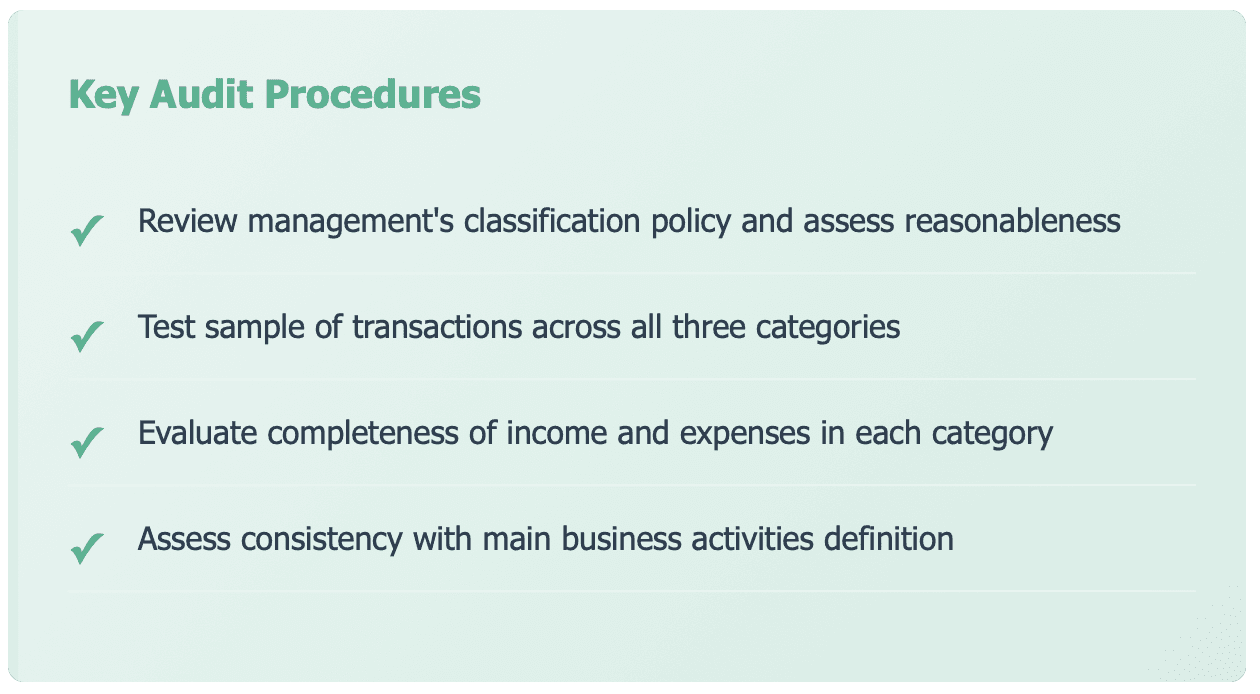

Audit firms should enhance their approach to address IFRS 18-specific risks:

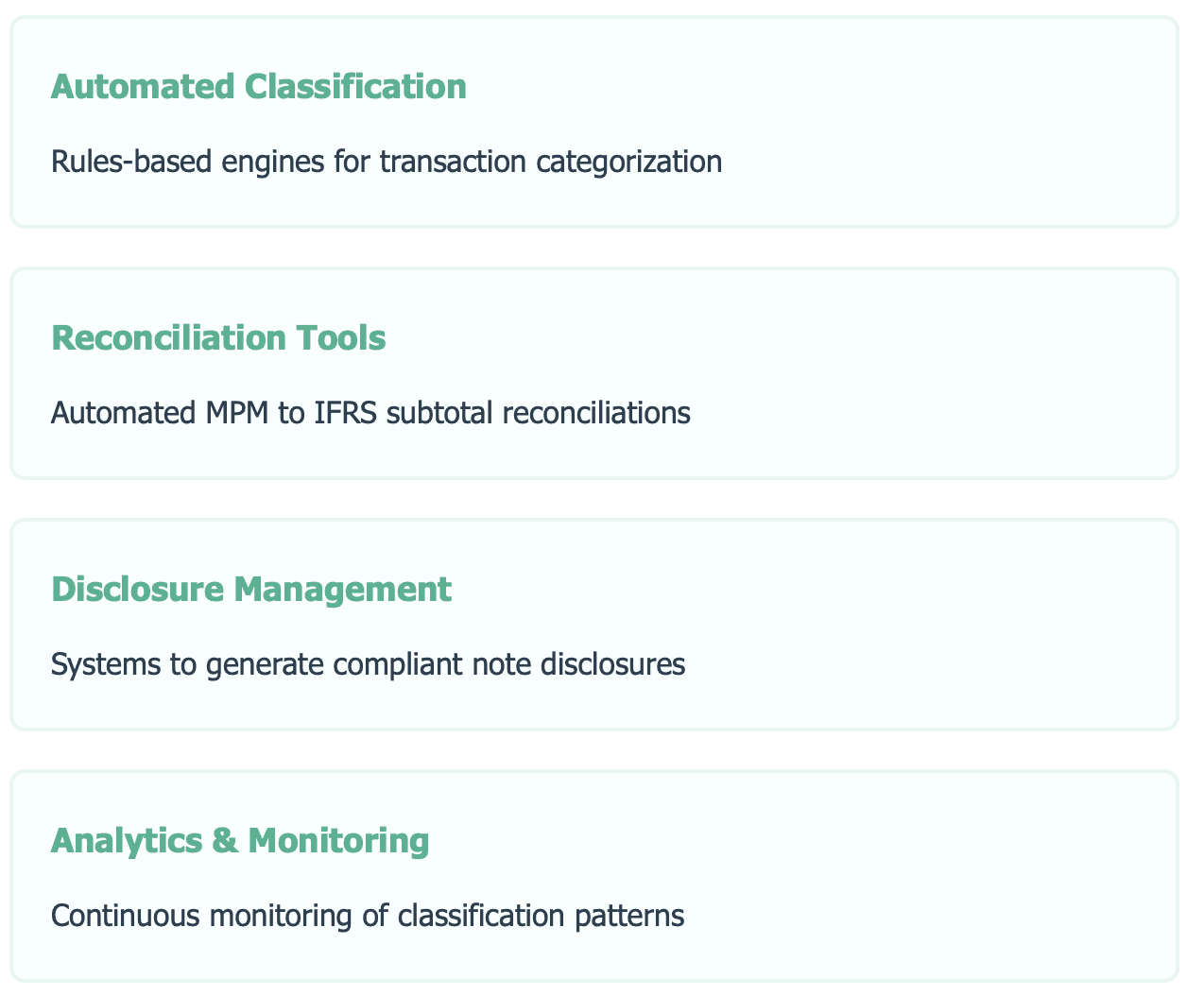

Technology Solutions

Leveraging technology can help mitigate implementation and ongoing compliance risks:

Industry-Specific Considerations

Financial Services

Banks and insurance companies face unique challenges given the nature of their income and expenses. Interest income and expense classification, particularly for portfolios of investments, requires careful analysis under IFRS 18's main business activities approach.

Investment Entities

Entities whose primary business is investing face questions about what constitutes "operating" activities. The standard provides some relief but significant judgment remains.

Multinational Conglomerates

Groups with diverse business activities must apply IFRS 18 consistently across different operations, which may have varying business models. The challenge of developing group-wide policies that accommodate this diversity shouldn't be underestimated.