Back

Scaling Up: How the SEC is Making the Stock Market Accessible for Small Businesses

Gana Misra

Jan 12, 2026

SEC

Updates

For decades, the stock market has been perceived as the exclusive domain of corporate giants—companies with billions in revenue, armies of lawyers, and the resources to navigate complex regulatory landscapes. But what about the local coffee roaster with a revolutionary business model? The tech startup creating groundbreaking software? The sustainable fashion brand capturing hearts nationwide?

The Securities and Exchange Commission (SEC) is rewriting the rules of engagement, and small businesses are finally getting their seat at the table.

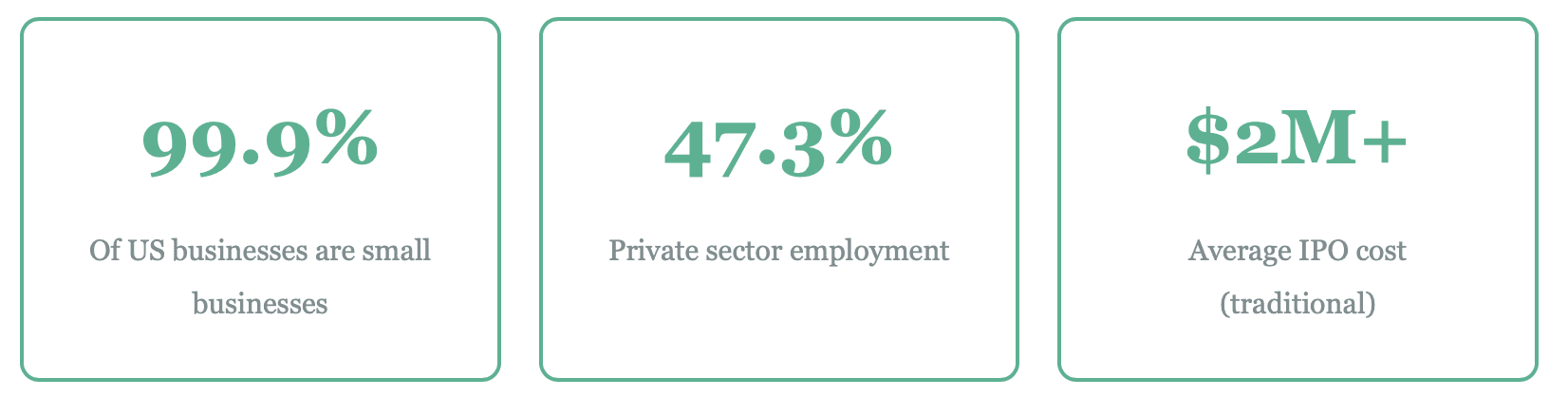

The Capital Access Challenge

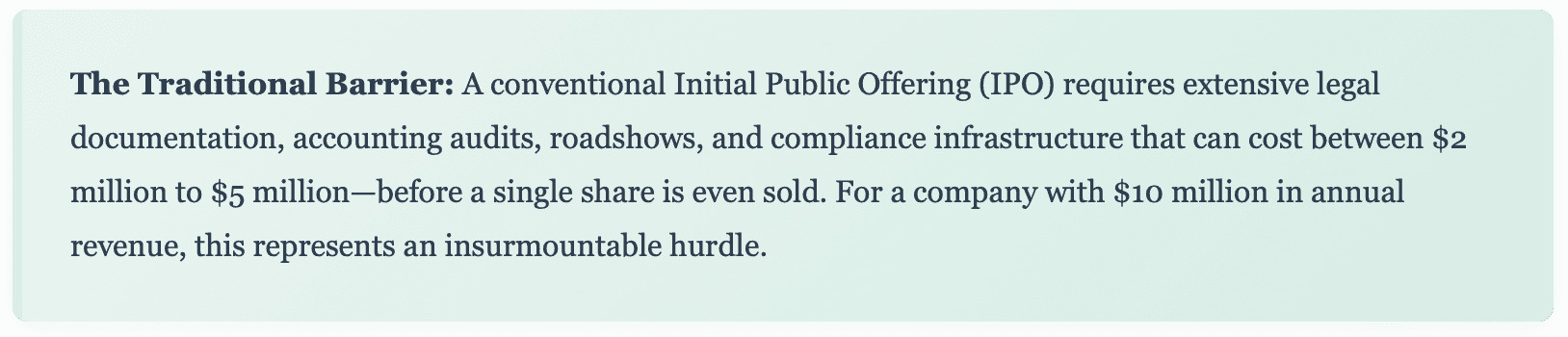

Small and medium-sized enterprises (SMEs) form the backbone of the American economy, accounting for nearly half of private sector employment. Yet when it comes to raising capital through public markets, they've historically faced a Catch-22: they need substantial funds to grow, but the cost and complexity of going public often exceeds what they can afford.

The SEC's Game-Changing Reforms

Recognizing this disparity, the SEC has introduced several innovative frameworks designed to democratize access to capital markets. These aren't just minor tweaks—they represent a fundamental reimagining of how businesses can connect with investors.

1. Regulation A+: The "Mini-IPO"

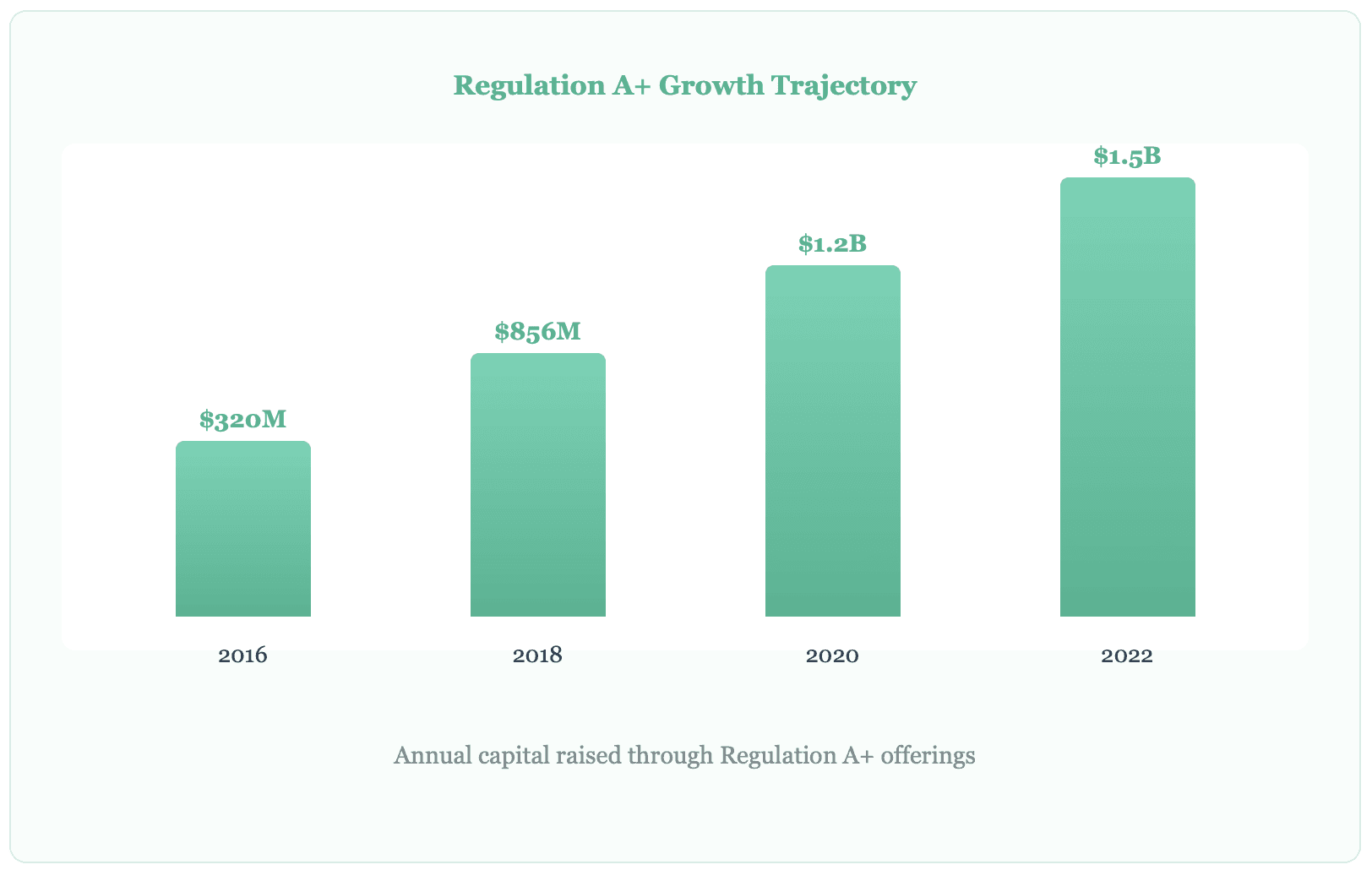

Often called the "IPO's little sibling," Regulation A+ allows companies to raise up to $75 million annually from both accredited and non-accredited investors without the full burden of traditional IPO requirements. Think of it as a middle path between private fundraising and a full-blown public offering.

Key advantages:

Significantly lower compliance costs (typically $250,000-$500,000)

Ability to "test the waters" with potential investors before filing

Shares can be freely tradable immediately

Marketing to general public allowed

2. Regulation Crowdfunding: Power to the People

In 2016, the SEC launched Regulation Crowdfunding, enabling businesses to raise up to $5 million annually from everyday investors through SEC-registered intermediaries. This isn't about donations—it's about equity ownership, allowing ordinary people to invest in businesses they believe in.

A craft brewery in Portland can now raise funds from its loyal customers, who become both investors and brand ambassadors. A renewable energy startup can tap into environmentally conscious investors nationwide. The traditional gatekeepers—venture capitalists and investment banks—no longer hold monopolistic power over who gets funded.

3. Regulation D Modernization

The SEC has also streamlined Regulation D offerings, which allow companies to raise unlimited capital from accredited investors. Recent amendments have simplified filing requirements and clarified advertising rules, making it easier for small businesses to connect with angel investors and private equity.

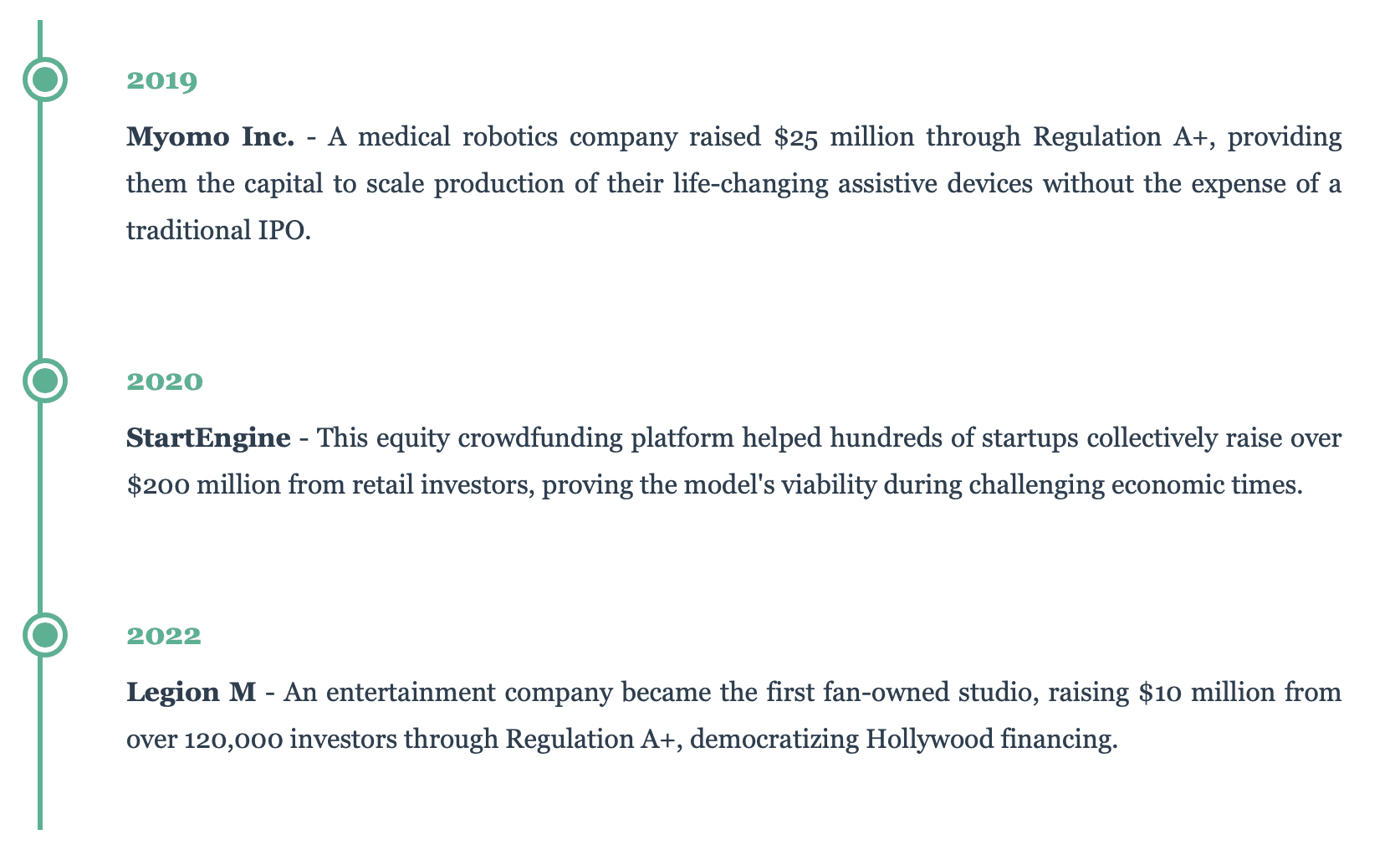

Real-World Success Stories

The Ripple Effects

These regulatory changes are creating cascading benefits throughout the economy:

Job Creation: Small businesses that successfully raise capital through these mechanisms grow faster, creating employment opportunities in their communities. SEC data suggests that companies using Regulation A+ create an average of 47 new jobs within two years of their offering.

Economic Diversity: By lowering barriers to entry, the SEC is enabling businesses in underserved communities and innovative sectors to access growth capital. Women-led and minority-owned businesses, historically underfunded by traditional venture capital, are finding new pathways to scale.

Investor Opportunity: Retail investors now have access to investment opportunities previously reserved for the wealthy. This democratization allows ordinary people to participate in wealth creation at earlier stages of business growth.

Challenges and Considerations

While the SEC's reforms are groundbreaking, they're not without challenges. Small businesses must still navigate disclosure requirements, understand their obligations to shareholders, and manage the complexities of being accountable to potentially thousands of investors.

The cost savings compared to traditional IPOs are substantial, but companies still need competent legal and financial advice. The democratization of investment also means companies must build investor relations capabilities they might not have needed with just a few angel investors or a single VC firm.

Additionally, not every business is ready or appropriate for public investment. Companies need solid business fundamentals, clear growth strategies, and the operational maturity to handle increased scrutiny and accountability.

The Future of Small Business Finance

The SEC continues to refine these regulations based on market feedback and evolving economic needs. Recent discussions have focused on further increasing the Regulation Crowdfunding limit, simplifying ongoing reporting requirements, and exploring blockchain-based securities that could further reduce costs and increase efficiency.

Technology is also playing a crucial role. Online platforms have made it easier than ever for businesses to conduct these offerings, connecting them with investors across the country with minimal overhead. Artificial intelligence tools are helping small businesses prepare the necessary documentation more affordably.

For entrepreneurs, this represents an unprecedented opportunity. For investors, it opens doors to participate in the American Dream at the ground floor. And for the economy as a whole, it means more diverse funding sources, more innovation, and a more resilient economic ecosystem.

The journey from local startup to public company is no longer an impossible dream—it's becoming an achievable reality, one regulatory reform at a time. The SEC's commitment to accessibility doesn't just change the rules of the game; it invites an entirely new set of players to the table.