Back

Why Top Financial Firms Are Switching from Intelligize to Finrep.ai

Gana Misra

Dec 2, 2025

Finance

AI

In the fast-paced world of financial research and regulatory compliance, the tools you use can make or break your competitive edge. For years, Intelligize has been a staple in many financial institutions. But recently, a seismic shift is occurring—top-tier financial firms are making the switch to Finrep.ai, and the reasons why are transforming the industry landscape.

The Bottom Line: While Intelligize served the market well in its time, Finrep.ai represents a fundamental leap forward in how financial professionals access, analyze, and act on critical information. This isn't just an upgrade—it's a revolution.

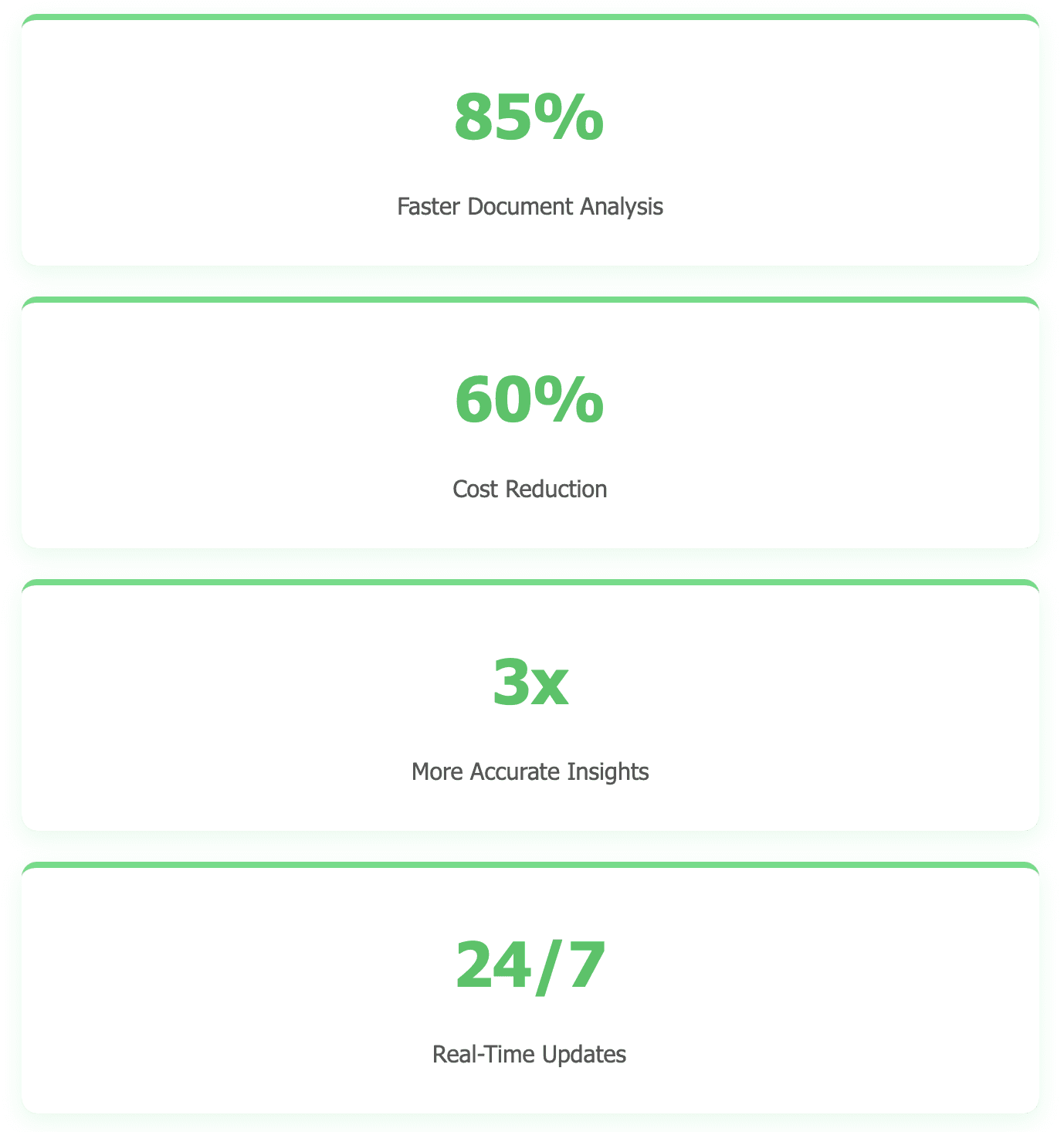

The Numbers Don't Lie

Key Differentiators: What Sets Finrep.ai Apart

When financial institutions evaluate research platforms, they're looking beyond basic functionality. Here's where Finrep.aidelivers transformative value that traditional platforms simply can't match:

Intelligent Data Processing

Finrep.ai's proprietary AI engine doesn't just search documents—it comprehends them. The platform analyzes relationships between data points, identifies anomalies, and surfaces insights that would take human analysts days or weeks to discover. This means you're not just finding information faster; you're discovering connections you didn't know existed.

Comprehensive Coverage with Context

While legacy platforms offer document repositories, Finrep.ai provides contextual intelligence. Every piece of data comes with relevant background, historical trends, and peer comparisons. Whether you're analyzing a 10-K filing or tracking regulatory changes, you get the full picture—not just raw documents.

Adaptive Learning Technology

The more you use Finrep.ai, the smarter it becomes. The platform learns your research patterns, anticipates your needs, and surfaces relevant information proactively. It's like having a research analyst who knows exactly what you need before you ask.

Enterprise-Grade Security and Compliance

In an era of increasing data regulations, Finrep.ai is built with security at its core. Bank-level encryption, comprehensive audit trails, and compliance with global data protection standards give you peace of mind while maximizing productivity.

The AI Advantage: Beyond Traditional Search

While Intelligize offers keyword search and document retrieval, Finrep.ai harnesses the power of advanced artificial intelligence to deliver something far more valuable: actionable intelligence.

Next-Generation AI Technology

Finrep.ai doesn't just find documents—it understands them. Using cutting-edge natural language processing and machine learning algorithms, the platform can:

Interpret context and intent: Ask questions in plain English and receive nuanced, comprehensive answers

Identify patterns across thousands of filings: Spot trends, risks, and opportunities that would take humans weeks to discover

Generate custom reports instantly: Transform raw data into executive-ready presentations in seconds

Predict regulatory changes: AI models analyze historical patterns to forecast upcoming compliance requirements

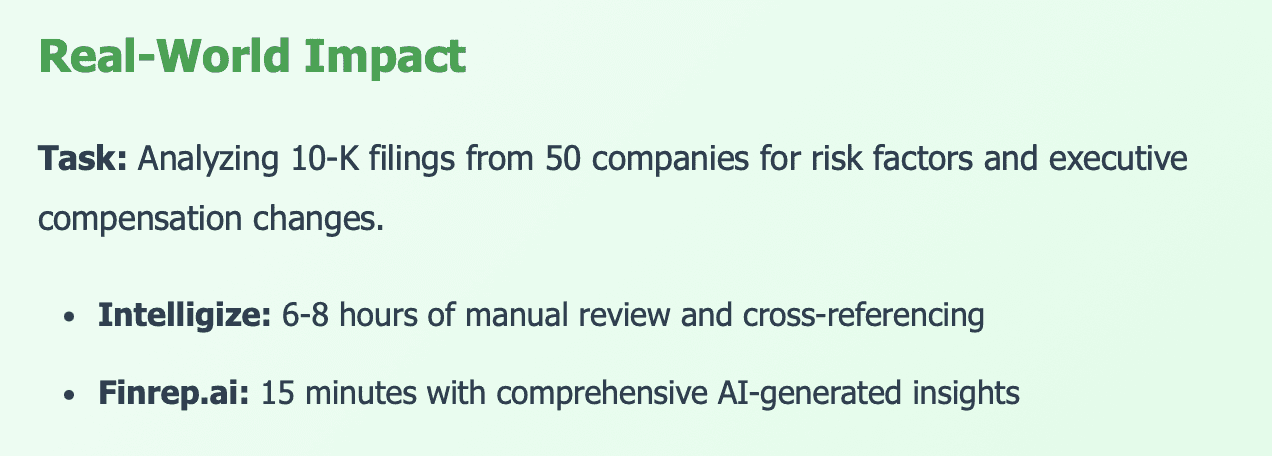

Speed: Time is Money, and Finrep.ai Saves Both

In finance, being first with accurate information can mean millions in competitive advantage. Here's where the rubber meets the road:

That's not a marginal improvement—it's a complete transformation of workflow efficiency.

Accuracy: The Foundation of Trust

Speed means nothing if the information is unreliable. Finrep.ai's AI models are trained on decades of financial documents and continuously refined to ensure:

Citation-backed responses: Every insight includes direct links to source documents

Multi-layer verification: AI cross-references multiple sources to validate findings

Reduced human error: Automated analysis eliminates the fatigue and oversight issues inherent in manual review

User Experience: Designed for Finance Professionals

Let's be honest—Intelligize's interface feels like it's stuck in 2010. Finrep.ai delivers a modern, intuitive experience that financial professionals actually enjoy using:

Key UX Advantages

Conversational interface: Ask questions naturally, as if speaking to an expert analyst

Customizable dashboards: Track the metrics and companies that matter to your specific role

Seamless collaboration: Share insights, annotate documents, and work together in real-time

Mobile optimization: Access critical information from anywhere, on any device

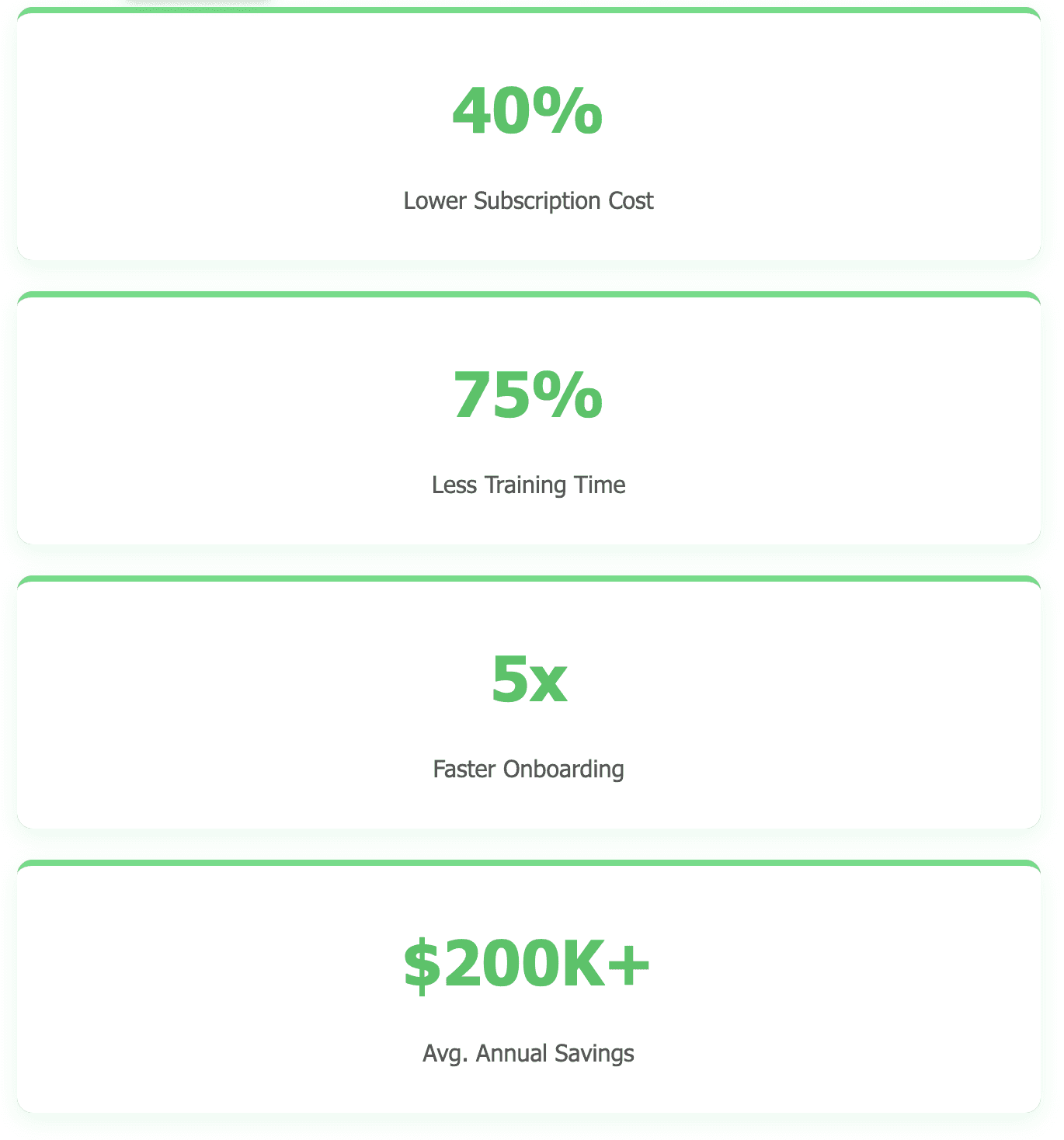

Cost Efficiency: More Value, Lower Total Cost of Ownership

When you factor in the true cost of research tools—licensing fees, training time, productivity losses, and opportunity costs—Finrep.ai delivers exceptional ROI:

Integration & Ecosystem: Built for Modern Tech Stacks

Finrep.ai isn't an isolated silo—it's designed to fit seamlessly into your existing technology infrastructure:

API access for custom integrations

Single sign-on (SSO) compatibility

Export to Excel, PowerPoint, PDF, and more

Slack, Teams, and email integration for alerts

Compliance with enterprise security standards (SOC 2, GDPR, etc.)

Why Financial Professionals Choose Finrep.ai

The decision to switch platforms isn't made lightly in the financial services industry. When top firms choose Finrep.ai, they're responding to tangible benefits that impact their bottom line and competitive positioning:

Investment Banking Teams

Deal teams rely on Finrep.ai to accelerate due diligence, identify risks faster, and deliver more comprehensive client presentations. The ability to analyze hundreds of comparable companies in minutes rather than days has fundamentally changed how M&A professionals work.

Private Equity Firms

Portfolio monitoring and new investment evaluation require deep, rapid analysis. Finrep.ai's sector-specific intelligence and trend identification capabilities help PE firms spot opportunities earlier and manage portfolio companies more effectively.

Legal and Compliance Departments

Staying ahead of regulatory changes is critical. Finrep.ai's predictive compliance alerts and automated disclosure analysis help legal teams maintain compliance while reducing manual review time by up to 80%.

Equity Research Analysts

Generating alpha requires insights competitors don't have. Finrep.ai's pattern recognition across thousands of filings helps analysts identify emerging trends, management red flags, and investment opportunities before they become consensus views.

The Migration Process: Easier Than You Think

Concerned about the transition? Finrep.ai's dedicated migration team ensures a smooth switch:

Personalized onboarding: Customized training sessions for your team

Data migration support: Transfer saved searches, folders, and preferences

Parallel access period: Run both systems simultaneously during transition

24/7 support: Dedicated account managers and technical assistance

Looking Forward: The Future of Financial Intelligence

The financial services industry is at an inflection point. As regulations become more complex, markets more interconnected, and competition more fierce, the tools that separate leaders from laggards are those that harness AI effectively.

Intelligize was built for yesterday's challenges. Finrep.ai is engineered for tomorrow's opportunities.

What's Next for Finrep.ai?

Predictive analytics for M&A activity

ESG risk scoring powered by AI

Automated compliance monitoring with real-time alerts

Enhanced global coverage across 50+ jurisdictions

The Verdict: Why Wait?

The migration from Intelligize to Finrep.ai isn't just happening because of better features or lower costs—though both are significant. It's happening because forward-thinking financial firms recognize that AI-powered intelligence platforms represent the future of the industry.

Every day spent with legacy tools is a day your competitors gain ground. The question isn't whether to make the switch—it's whether you can afford not to.