Back

Countdown to 2026: How the New ISA Changes the Rules for Market Operators

Gana Misra

Jan 9, 2026

SEC

Updates

Why This Matters: The ISA 2025 Revolution

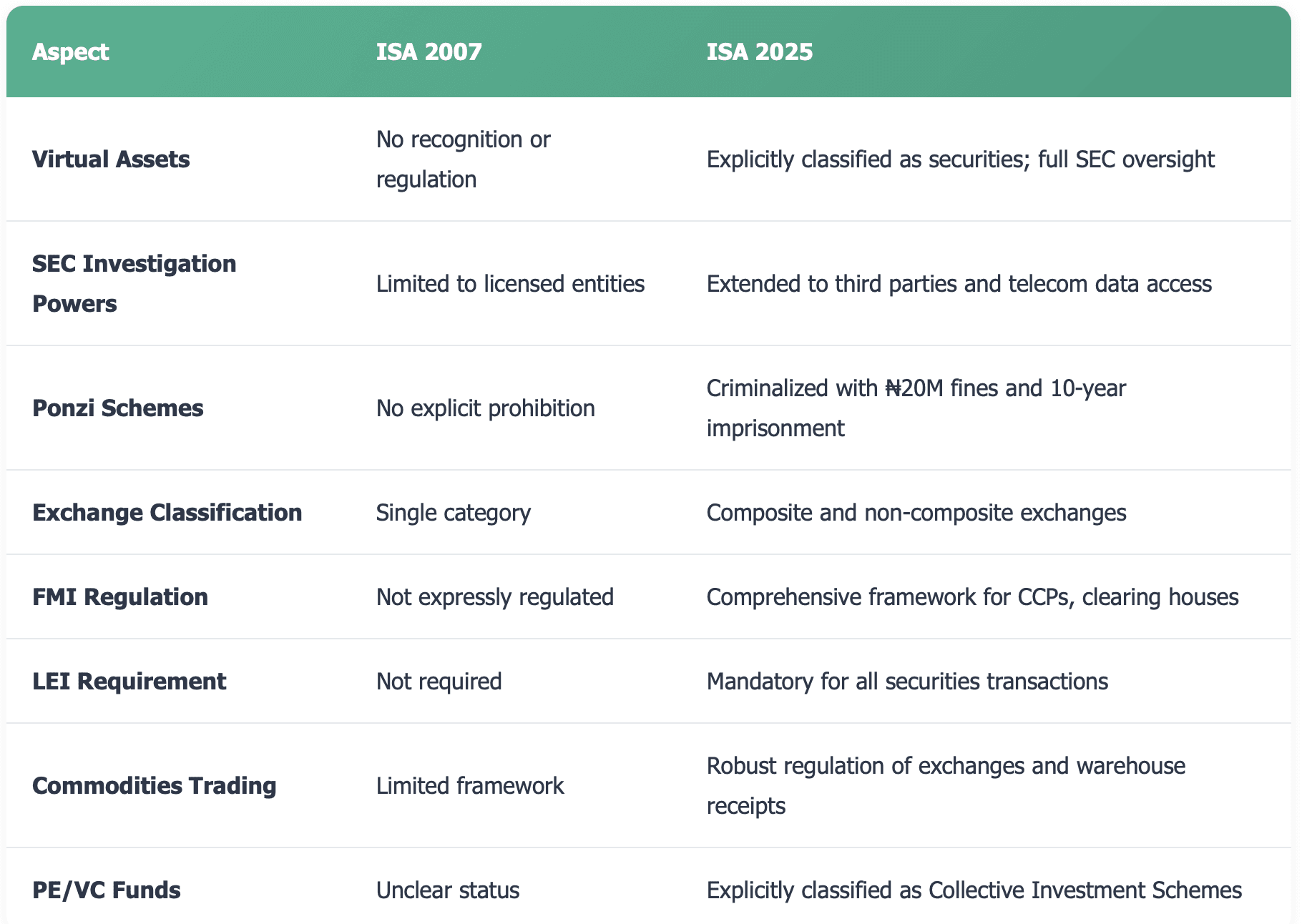

The ISA 2025 replaces the outdated 2007 Act, which had become inadequate for addressing modern market realities. Think about it: the previous legislation predated the cryptocurrency boom, the fintech revolution, and the explosion of digital trading platforms. It was like trying to regulate smartphones with laws written for rotary phones.

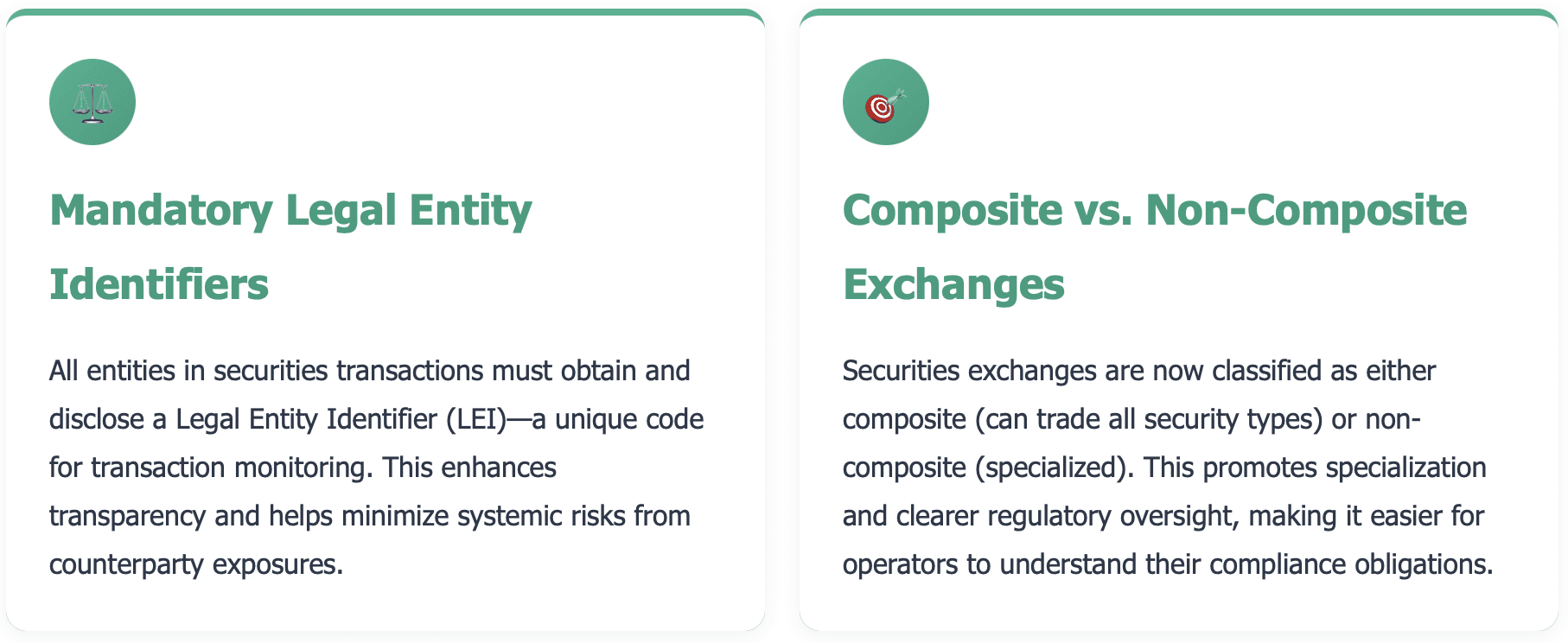

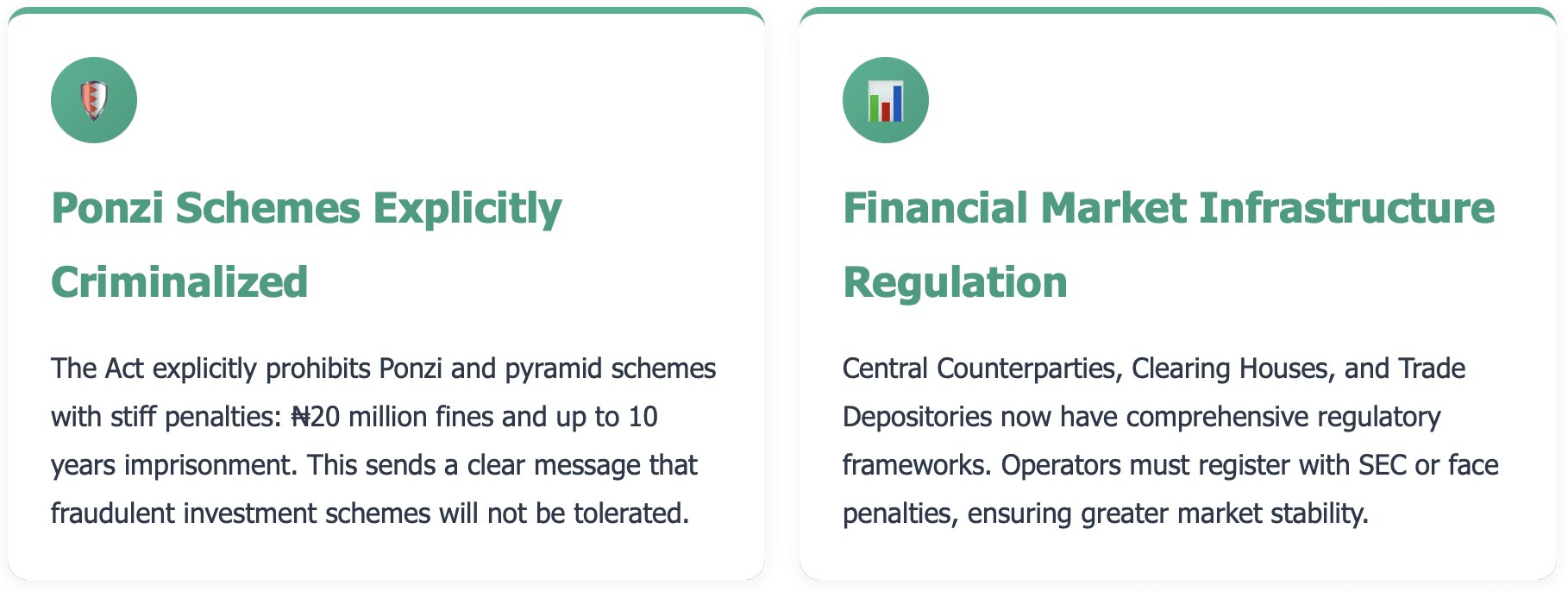

The Seismic Shifts: What's New for Market Operators

ISA 2007 vs ISA 2025: A Comparative Overview

What This Means for Different Market Players

For Traditional Capital Market Operators

Your registration certificates may be revoked if you engage in business activities you're not registered for. The SEC now has direct involvement in appointing and removing CEOs and principal officers. You'll need to stay laser-focused on compliance and may need to restructure operations to align with new classifications.

For Digital Asset Operators

Welcome to the regulated world. If you're offering crypto-related investment products, you must register with the SEC. The days of operating in regulatory gray areas are over. This is both a challenge and an opportunity—legitimate operators can now build trust with a regulatory stamp of approval.

For Fund Managers (PE/VC)

Your funds are now explicitly classified as Collective Investment Schemes (CIS). You can invest in infrastructure, private debt, unlisted equity, digital assets, commodities, and derivatives—but you need SEC approval. The framework is clearer, but compliance is non-negotiable.

For Commodities Exchanges and Warehouse Operators

You now have a comprehensive regulatory framework. Registration with SEC is mandatory, and you'll face stiff penalties for non-compliance. This brings clarity and legitimacy to the commodities ecosystem in Nigeria.

Your Action Plan: Steps to Ensure Compliance by January 2026

Conduct Immediate Compliance AuditReview all your operations against ISA 2025 requirements. Identify gaps in registration, licensing, reporting, and operational procedures.

Register All Tradable InstrumentsEnsure every instrument under your management is fully registered with the SEC. This is non-negotiable and must be completed by the January 2026 deadline.

Obtain Legal Entity IdentifierIf you haven't already, secure your LEI from an authorized issuer. This is mandatory for all securities transactions.

Review and Update Governance StructuresUnderstand that the SEC now has a say in appointing and removing principal officers. Ensure your governance framework can accommodate this oversight.

Assess Digital Asset ExposureIf you deal with virtual assets in any capacity, ensure you have or are applying for the appropriate licenses. Unlicensed crypto operations are now illegal.

Engage Legal and Compliance ExpertsThe ISA 2025 is complex. Work with professionals who understand both the letter and spirit of the new regulations.

Prepare for Enhanced ReportingThe SEC's investigative powers have expanded. Ensure your record-keeping, data management, and reporting systems are robust and transparent.

Declare Compliance StatusFormally notify the SEC of your compliance status as directed. Don't wait until the last minute.

The Silver Lining: Opportunities in the New Era

While the ISA 2025 brings stricter regulation, it also creates significant opportunities:

Looking Ahead: The 2026 Landscape

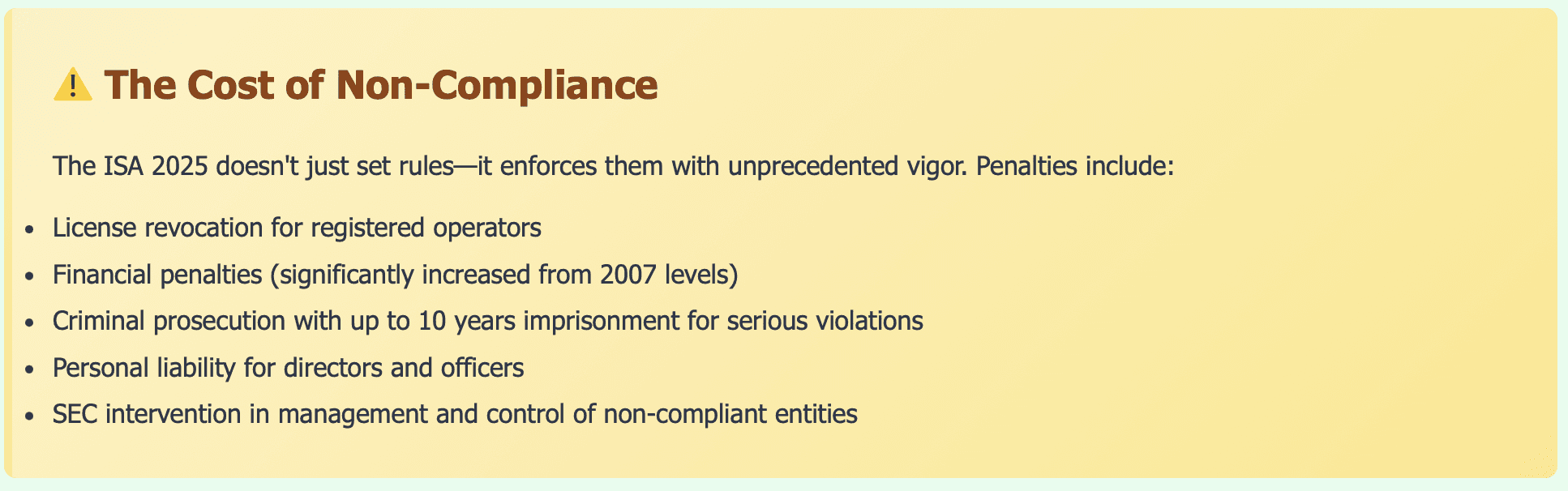

By the time the January 2026 deadline passes, Nigeria's capital market will be fundamentally different. The SEC has made it clear that 2026 will see intensified enforcement. Emomotimi Agama, the Director-General of SEC, emphasized that the Commission will act "firmly and impartially" to address market abuse, insider dealing, and fraudulent schemes.

This isn't just regulatory posturing. The Commission now has the legal tools, the expanded mandate, and the political backing to reshape the market. Operators who adapt will thrive in a more transparent, efficient market. Those who resist or ignore the changes risk being left behind—or worse, facing severe penalties.

Final Thoughts

The countdown to 2026 represents more than just a deadline—it's a countdown to a new era for Nigeria's capital markets. The ISA 2025 is ambitious, comprehensive, and necessary. It reflects a market that's grown up, learned from past failures, and is ready to compete globally.

For market operators, the choice is clear: embrace the change, invest in compliance, and position yourself as a trusted player in this new landscape. The clock is ticking, but opportunity favors those who act decisively and strategically.